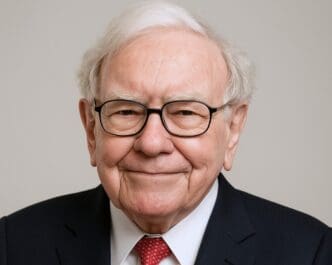

Warren Buffett, the celebrated CEO of Berkshire Hathaway, has built a multi-billion dollar fortune and a legendary reputation not through complex algorithms or risky speculation, but by adhering to a disciplined investment philosophy known as value investing. For decades, from his headquarters in Omaha, Nebraska, Buffett has demonstrated that the key to long-term wealth creation is surprisingly simple: identify outstanding businesses, determine their true underlying worth, and buy them at a price that offers a significant discount. This approach, which treats buying a stock as buying a piece of a real business, provides a powerful and timeless framework for everyday investors seeking to navigate the market’s volatility and build sustainable financial security.

The Oracle of Omaha: More Than Just an Investor

To understand the philosophy, one must first understand the man. Warren Buffett, often called the “Oracle of Omaha,” is revered not just for his immense wealth, but for his wisdom, humility, and ability to communicate complex financial concepts in simple, folksy terms. He is the chairman and CEO of Berkshire Hathaway, a former textile company he transformed into a sprawling conglomerate holding stakes in some of America’s most iconic brands, including GEICO, Duracell, Dairy Queen, and major positions in Apple and Coca-Cola.

Unlike many Wall Street titans, Buffett’s strategy isn’t about chasing fleeting trends or timing market swings. Instead, his entire career has been a masterclass in patience, discipline, and focusing on the fundamental, long-term value of a business. His annual letters to Berkshire Hathaway shareholders are considered essential reading for investors worldwide, filled with candid insights on business, management, and life.

The Core Tenets of Buffett’s Philosophy

Buffett’s approach is rooted in the principles of his mentor, Benjamin Graham, the “father of value investing.” However, over the years, with influence from his partner Charlie Munger, Buffett has evolved this foundation into a unique and powerful strategy. Here are the cornerstones of his philosophy.

Invest Within Your “Circle of Competence”

One of Buffett’s most famous maxims is to never invest in a business you cannot understand. This concept, the “circle of competence,” is about sticking to industries and companies whose operations, revenue streams, and competitive landscape you can reasonably comprehend. It’s a simple defense against making uninformed decisions based on hype or speculation.

For Buffett, this meant historically avoiding the tech booms of the late 1990s, as he admittedly didn’t understand their business models. Conversely, he deeply understands brands, insurance, and banking. His investment in Coca-Cola in the 1980s was a classic example; he could easily grasp how its powerful brand and global distribution network created a durable and profitable business.

For a beginner, this means starting with what you know. If you work in healthcare, you might have a better understanding of pharmaceutical companies. If you’re a retail enthusiast, you may have unique insights into consumer brands. The goal is to gain an analytical edge, however small, by focusing on familiar territory.

View the Market as “Mr. Market”

To manage the emotional turmoil of market fluctuations, Buffett champions Benjamin Graham’s allegory of “Mr. Market.” Imagine you have a business partner, Mr. Market, who is manic-depressive. Every day, he offers to either buy your shares or sell you his at a specific price. Some days he is euphoric and quotes a ridiculously high price; other days he is despondent and offers to sell at a deep discount.

The key is to remember that you are not obligated to transact with him. A smart investor ignores Mr. Market on his euphoric days and happily buys from him when he is pessimistic and offering bargains. This metaphor teaches investors to view market volatility as an opportunity, not a threat. The stock’s price is what Mr. Market is shouting; the business’s value is what you have calmly calculated.

Seek Businesses with a Durable “Economic Moat”

A central pillar of the modern Buffett strategy is the concept of an “economic moat.” Coined by Buffett, a moat is a durable competitive advantage that protects a company from competitors, much like a real moat protects a castle. This advantage allows the company to sustain high returns on capital for long periods.

Moats can come in several forms:

- Brand Power: Companies like Apple or Coca-Cola have brands so powerful that customers are willing to pay a premium for their products over generic equivalents.

- Switching Costs: It can be costly or inconvenient for customers to switch to a competitor. Think of banks or software providers where moving your data and history is a major hassle.

- Network Effects: A service becomes more valuable as more people use it. American Express is a classic example; more merchants accept it because more cardholders use it, and vice versa.

- Cost Advantages: Some companies, like GEICO with its direct-to-consumer model or Walmart with its massive scale, can operate at a lower cost than rivals, allowing them to either undercut on price or enjoy higher margins.

Buffett seeks companies with wide, sustainable moats because they are more predictable and resilient. They can weather economic downturns and fend off competition, making their future earnings easier to forecast.

Demand a “Margin of Safety”

This is perhaps the most critical principle inherited from Benjamin Graham. The margin of safety is the difference between a company’s intrinsic value and the price you pay for its stock. In simple terms, it means buying a dollar’s worth of business for 50 cents. By insisting on a significant discount, you build in a buffer against errors in your analysis, unforeseen problems, or general bad luck.

Calculating a precise intrinsic value is more art than science, but it involves analyzing a company’s assets, earnings power, and future growth prospects. Even if your calculation is slightly off, a large margin of safety protects your principal investment. It is the investor’s ultimate defense against the inevitable uncertainties of the future.

Adopt a Long-Term Business Perspective

Warren Buffett famously said, “Our favorite holding period is forever.” He doesn’t see stocks as flashing symbols on a screen but as ownership stakes in real businesses. When Berkshire Hathaway buys a stock, they are buying a company with the intention of holding it for years, or even decades.

This long-term horizon allows the power of compounding to work its magic and frees the investor from the anxiety of trying to predict short-term market moves. It encourages a focus on the quality of the business and its management team, rather than on quarterly earnings reports or daily price swings. If you aren’t willing to own a stock for ten years, Buffett argues, you shouldn’t even think about owning it for ten minutes.

From “Cigar Butts” to Wonderful Companies

It’s important for beginners to know that Buffett’s philosophy has evolved. His early strategy, directly from Graham, was what he called the “cigar-butt” approach. This involved finding deeply troubled but statistically cheap companies, like a discarded cigar butt on the street with one free puff left in it. You could pick it up, get that last puff for free, and then toss it.

While profitable, this strategy involved buying mediocre businesses at wonderful prices. It was his longtime partner, Charlie Munger, who convinced him to shift his focus. Munger argued, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

The acquisition of See’s Candies in 1972 was a turning point. It wasn’t statistically cheap, but it was a phenomenal business with a powerful brand and pricing power—a wide economic moat. The success of this investment taught Buffett that paying a fair price for a high-quality business that could grow its earnings for decades was a much better, and easier, path to wealth than buying bargain-bin companies.

A Beginner’s Action Plan for Value Investing

Adopting Buffett’s philosophy is a marathon, not a sprint. It requires a shift in mindset from speculating to owning.

1. Start Reading and Learning

Begin by reading Buffett’s annual letters to shareholders, which are available for free on the Berkshire Hathaway website. Also, read foundational texts like “The Intelligent Investor” by Benjamin Graham. The goal is to build your “circle of competence” one page at a time.

2. Analyze Businesses, Not Tickers

Pick a few simple, public companies you already understand as a consumer. Go to their investor relations website and download their latest annual report (Form 10-K). Try to answer basic questions: How does this company make money? Who are its main competitors? What is its debt level? Who is running the company?

3. Be Patient and Disciplined

Create a watchlist of wonderful companies you’d love to own. Then, wait. As Buffett says, “The stock market is a no-called-strike game. You don’t have to swing at everything.” Wait for Mr. Market to get pessimistic and offer you one of your chosen companies at a price that includes a significant margin of safety.

Conclusion: A Philosophy for a Lifetime

Warren Buffett’s investment philosophy is not a get-rich-quick scheme. It is a robust, common-sense framework for building long-term wealth by becoming a part-owner in excellent businesses. By focusing on what you understand, seeking durable competitive advantages, demanding a margin of safety, and exercising immense patience, any investor can apply the wisdom of the Oracle of Omaha to their own financial journey. It’s a strategy that rewards discipline and independent thought over emotional reaction and herd mentality—a timeless lesson in today’s fast-paced world.