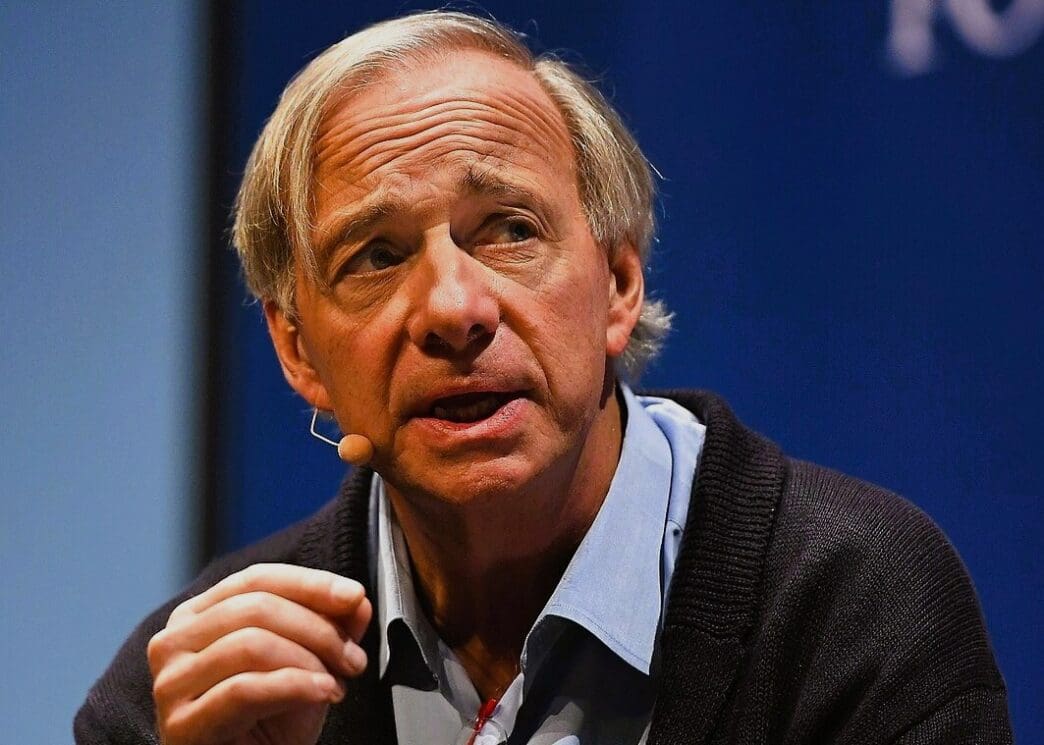

Ray Dalio, the billionaire founder of the world’s largest hedge fund, Bridgewater Associates, codified a lifetime of lessons into his 2017 bestseller, Principles: Life and Work. These rules, developed over four decades of navigating volatile global markets, represent a systematic approach to decision-making that transformed his firm into a $150 billion powerhouse. For the everyday person trying to build wealth, the central question is whether this framework, forged in the high-stakes world of institutional finance, can be distilled into practical wisdom. The answer, for those willing to embrace its core tenets of radical truthfulness and systematic thinking, is a definitive yes, offering a powerful blueprint for becoming a more rational, resilient, and successful investor.

Who is Ray Dalio and What Are the Principles?

To understand the Principles, one must first understand the man and the crucible in which they were formed. Ray Dalio is not a typical Wall Street titan. He is a macro investor who studies the grand, sweeping cycles of history and economics to inform his trades.

His journey provides the critical context for his philosophy. After founding Bridgewater from his two-bedroom New York apartment in 1975, he experienced a catastrophic failure in the early 1980s. He incorrectly predicted a global debt crisis and a U.S. depression, a bet so wrong it nearly bankrupted his firm and forced him to borrow money from his father to support his family. This humbling experience became the bedrock of his future success.

The Pain Button and the Idea Meritocracy

Dalio realized that his own ego and blind spots were his greatest enemies. He vowed to never again be so certain of a belief that it could ruin him. This led to the development of what he calls an “idea meritocracy,” a culture where the best ideas win out, regardless of who they come from.

To achieve this, he instilled two core concepts at Bridgewater: Radical Truthfulness and Radical Transparency. Employees are expected to voice their disagreements and critiques openly, and most meetings are recorded and made available for anyone at the firm to review. The goal is to stress-test every idea from every angle, replacing subjective opinion with evidence-based reasoning. For investors, this concept is a direct antidote to the dangerous echo chambers of social media and confirmation bias.

Key Principles for Individual Investors

While many of Dalio’s work principles are tailored for managing a large organization, his life principles offer a universal guide to better decision-making. When applied to investing, they create a powerful mental model for navigating the uncertainty of the markets.

Principle 1: Embrace Reality and Deal with It

“Truth—more precisely, an accurate understanding of reality—is the essential foundation for any good outcome,” Dalio writes. For an investor, this means confronting the facts of your portfolio and the market, not the story you wish were true. Hope is not a strategy.

If a stock you own is declining, the first step is to acknowledge that reality without emotion. Is it part of a broader market downturn, or is something fundamentally wrong with the company? Ignoring red flags because you are emotionally attached to a company is a classic retail investor mistake. Embracing reality means looking at deteriorating financials, increased competition, or a flawed business model with cold, hard objectivity.

Principle 2: Use the 5-Step Process

Dalio presents a simple yet profound loop for achieving goals. This process can be directly mapped onto an individual’s financial journey.

- Have clear goals. Be specific. “I want to retire comfortably” is a wish. “I want to accumulate $1.5 million by age 65 to generate $60,000 in annual income” is a goal.

- Identify the problems. What stands in your way? “My savings rate is too low, and my portfolio is too concentrated in speculative stocks.”

- Diagnose the problems. Find the root cause. “I engage in ‘lifestyle creep’ whenever I get a raise instead of increasing my savings, and I chase hot stocks I hear about online out of a fear of missing out (FOMO).”

- Design a plan. What is the solution? “I will create a formal budget, automate a 15% savings contribution to my retirement account each month, and build a diversified portfolio based on low-cost index funds.”

- Execute. Put the plan into action. Set up the automatic transfers. Rebalance your portfolio. Stick to the plan and avoid tinkering based on market noise.

Principle 3: Be Radically Open-Minded

Dalio argues that the two biggest barriers to good decision-making are your ego and your blind spots. Being radically open-minded is the cure. In investing, this means actively seeking out dissenting opinions and understanding the bear case for every investment you make.

If you are bullish on a particular sector, like artificial intelligence, don’t just consume content that confirms your view. Make it a priority to read well-reasoned arguments from skeptics who highlight risks like high valuations, regulatory hurdles, or competitive threats. This isn’t about becoming pessimistic; it’s about making your investment thesis stronger by stress-testing it against opposing views.

Principle 4: Learn How to Make Decisions Effectively

A cornerstone of Dalio’s philosophy is “believability-weighted decision making.” This means weighing the opinions of credible experts more heavily than those of less-informed individuals. Not all opinions are created equal.

For an investor, this is a crucial filter in an age of information overload. A detailed research report from a seasoned financial analyst with a multi-decade track record is more “believable” than an anonymous tip on a social media forum. Learn to identify and prioritize credible sources, whether they are respected financial journalists, seasoned fund managers, or academic researchers. Use their insights as high-quality inputs into your own, independent thinking.

The “Holy Grail” of Investing

Perhaps Dalio’s most famous contribution to investment strategy is his concept of the “Holy Grail.” He discovered that by combining 15 to 20 “good, uncorrelated return streams,” he could dramatically lower his portfolio’s risk without lowering its expected returns.

The key word here is uncorrelated. This means owning assets that behave differently from one another in various economic environments. Most investors think they are diversified because they own 20 different stocks. But if all those stocks are U.S.-based technology companies, they are highly correlated and will likely fall together during a tech-sector downturn.

True diversification, in Dalio’s view, means spreading investments across different asset classes (stocks, bonds, commodities), different economies (U.S., Europe, Asia), and different currencies. The goal is to build a portfolio where some assets will perform well even when others are struggling, creating a smoother, less volatile journey toward your financial goals.

Putting Principles into Practice: The All-Weather Portfolio

The All-Weather Portfolio is the practical application of Dalio’s principles, specifically the Holy Grail concept. It was designed to be a portfolio that could perform reasonably well regardless of the economic season—whether growth is rising or falling, and whether inflation is rising or falling.

The All-Weather Allocation

While the exact weightings can be debated and adjusted, a commonly cited version of the All-Weather strategy allocates assets as follows:

- 40% Long-Term U.S. Bonds: Performs well during periods of falling growth or deflation (recessions).

- 30% U.S. Stocks: Performs well during periods of rising growth and falling inflation.

- 15% Intermediate-Term U.S. Bonds: A less volatile component of the bond allocation.

- 7.5% Gold: Performs well during periods of high inflation and currency devaluation.

- 7.5% Broad Commodities: Performs well during periods of rising inflation.

The most striking feature is the large allocation to bonds, which is designed to counterbalance the inherent volatility of the stock allocation. It is a fundamentally conservative portfolio built for capital preservation and resilience, not for maximizing short-term gains.

While it will almost certainly underperform an all-stock portfolio during a roaring bull market, its strength lies in its ability to mitigate large drawdowns during a crisis. For many investors, this stability is the key to staying invested for the long term and avoiding the catastrophic mistake of panic-selling at the bottom.

Conclusion: A Framework for Thinking

Ray Dalio’s “Principles” do not offer a secret formula for picking winning stocks or timing the market. Their value is far more profound. They provide a robust mental framework for making better decisions in a complex and uncertain world, which is the very essence of investing.

By learning to confront reality, systematically pursue goals, challenge one’s own beliefs, and build a truly resilient portfolio, any individual can elevate their investment process. The ultimate lesson from Dalio is not what to think, but how to think—a principle that pays dividends far beyond any single investment.