Executive Summary

- China’s Ministry of Commerce imposed new export controls on lithium battery components and associated technology, effective November 8.

- The announcement led to a significant plunge in shares of major Chinese battery manufacturers, including CATL, Tianqi Lithium, and EVE Energy.

- These controls are interpreted as Beijing’s latest strategic effort to tighten its grip on critical technologies essential for energy storage and electric vehicles amidst ongoing trade tensions.

The Story So Far

- China’s new export controls on lithium battery components are a strategic move to tighten its grip on critical technologies essential for energy storage and electric vehicles, reflecting its broader intent to control key segments of the global clean energy supply chain. This action unfolds amidst simmering trade tensions with the United States and comes ahead of a potential meeting between President Trump and President Xi Jinping, suggesting a calculated effort to leverage its advanced manufacturing capabilities and critical mineral resources in the international geopolitical landscape.

Why This Matters

- China’s new export controls on lithium battery components significantly tighten its strategic grip on the global clean energy supply chain, potentially creating supply chain risks and uncertainty for foreign producers and joint ventures reliant on these critical inputs. This move, amidst simmering trade tensions with the United States and ahead of a potential meeting between President Trump and President Xi Jinping, has already triggered a sharp decline in Chinese battery makers’ shares, signaling market concern over future availability and costs of essential EV and energy storage materials.

Who Thinks What?

- China’s Ministry of Commerce implemented new export controls on lithium battery components and related technology to tighten its grip on critical technologies essential for energy storage and electric vehicles, bolstering control over key segments of the global supply chain.

- Cory Combs, head of critical mineral research at Trivium China, views the controls as a drastic expansion of China’s claim over the lithium battery supply chain, warning of potential risks for foreign producers and Chinese overseas joint ventures if export licenses are restricted.

- Analysts at Zaoshang Securities suggest the controls will have limited impact, are unlikely to result in outright bans, and will only require a short permit process, noting that previous controls on similar items did not lead to a major decrease in exports.

China’s Ministry of Commerce announced new export controls on lithium battery components and related technology, effective November 8, leading to a significant plunge in shares of major Chinese battery makers on Friday. This strategic move is widely interpreted as Beijing’s latest effort to tighten its grip on critical technologies essential for energy storage and electric vehicles, amidst simmering trade tensions with the United States and ahead of a potential meeting between President Trump and President Xi Jinping.

New Export Controls and Market Reaction

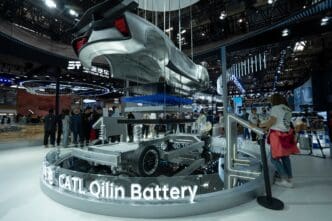

The Ministry of Commerce stated on Thursday that high-end lithium-ion batteries, cathodes, graphite anode material, and associated technological know-how will now require export permits. This expansion of controls follows previous restrictions on rare earths, signaling China’s continued intent to bolster its control over key segments of the global supply chain for clean energy technologies.

The announcement immediately impacted Chinese battery manufacturers, whose shares saw substantial declines. Contemporary Amperex Technology Co Ltd. (CATL) tumbled 6.82%, Tianqi Lithium sank 7.17%, and EVE Energy slumped nearly 11%. BYD also experienced a drop of 2.54% by market close, contributing to a 6.02% fall in China’s New Energy Vehicles Index.

Industry Perspectives and Broader Context

Cory Combs, head of critical mineral research at Trivium China, emphasized that these new controls “drastically expand how much of the lithium battery supply chain China is staking a claim to.” Combs warned that foreign producers and Chinese overseas joint ventures could face risks if Beijing decides to slow-walk or limit export licenses for these essential inputs.

However, analysts at Zaoshang Securities offered a more subdued outlook, suggesting the controls are unlikely to result in outright bans and will have limited impact, requiring only a short permit process. They noted that previous rounds of controls on items like natural graphite did not lead to a major decrease in exports. The market downturn was also influenced by a simultaneous revision to China’s electric vehicle tax exemptions, which tightened eligibility criteria.

These new export regulations underscore China’s strategic intent to manage its advanced manufacturing capabilities and critical mineral resources. The global automotive and energy sectors will closely monitor the implementation of these controls and their implications for international supply chains, particularly given the reliance of overseas Chinese-invested plants on these key inputs.