Executive Summary

- China has expanded its export control list for five additional rare earth elements and related materials, requiring export licenses, in a move perceived as a direct response to President Trump’s tariffs.

- President Trump threatened economic retaliation against China’s rare earth restrictions and hinted at canceling an upcoming meeting with Chinese President Xi Jinping.

- China maintains near-total control over rare earth minerals, accounting for 61% of global mined production and 92% of processing capacity, giving it significant leverage over the United States, which heavily relies on these minerals for technology and defense.

The Story So Far

- The increased restrictions on rare earth exports by China are a direct escalation within an ongoing trade dispute with the United States. This action leverages China’s long-standing, near-total control over the production and processing of these critical minerals, which are indispensable for global technology and defense sectors, thereby exploiting the United States’ significant dependence on China for these materials.

Why This Matters

- China’s expanded restrictions on rare earth exports, a retaliatory measure against President Trump’s tariffs, mark a significant escalation in the ongoing trade dispute, prompting threats of further US economic countermeasures. This strategic move highlights the critical vulnerability of global technology and defense sectors, particularly in the US, which heavily relies on China for these indispensable minerals, potentially disrupting supply chains for everything from smartphones to advanced military systems and underscoring Beijing’s leverage in international trade.

Who Thinks What?

- China expanded its control list on rare earth elements, requiring export licenses, a move perceived as a direct response to President Trump’s “reciprocal tariffs” and a demonstration of its long-standing industrial policy to control these critical minerals.

- President Donald Trump threatened economic retaliation against China’s increased rare earth export restrictions, vowing to “financially counter their move” and hinting at canceling an upcoming meeting with Chinese President Xi Jinping.

China’s increased restrictions on its rare earth exports have prompted a strong response from President Donald Trump, who threatened economic retaliation and hinted at canceling an upcoming meeting with Chinese President Xi Jinping. This escalation comes amidst an ongoing trade dispute, highlighting the critical role of these minerals in global technology and defense sectors.

Beijing expanded its control list on Thursday to include five additional rare earth elements—holmium, erbium, thulium, europium, ytterbium—along with related magnets and materials, now requiring export licenses. This move is perceived as a direct response to Trump’s “reciprocal tariffs” on Chinese goods, despite earlier expectations for eased restrictions following a trade truce between the two nations.

China not only leads in mining but also controls the vast majority of global rare earth processing, a crucial and strategic part of the supply chain.

China has systematically built near-total control over rare earth minerals for years as part of its wider industrial policy. This long-standing dominance provides Beijing with significant leverage in international trade relations, particularly with the United States.

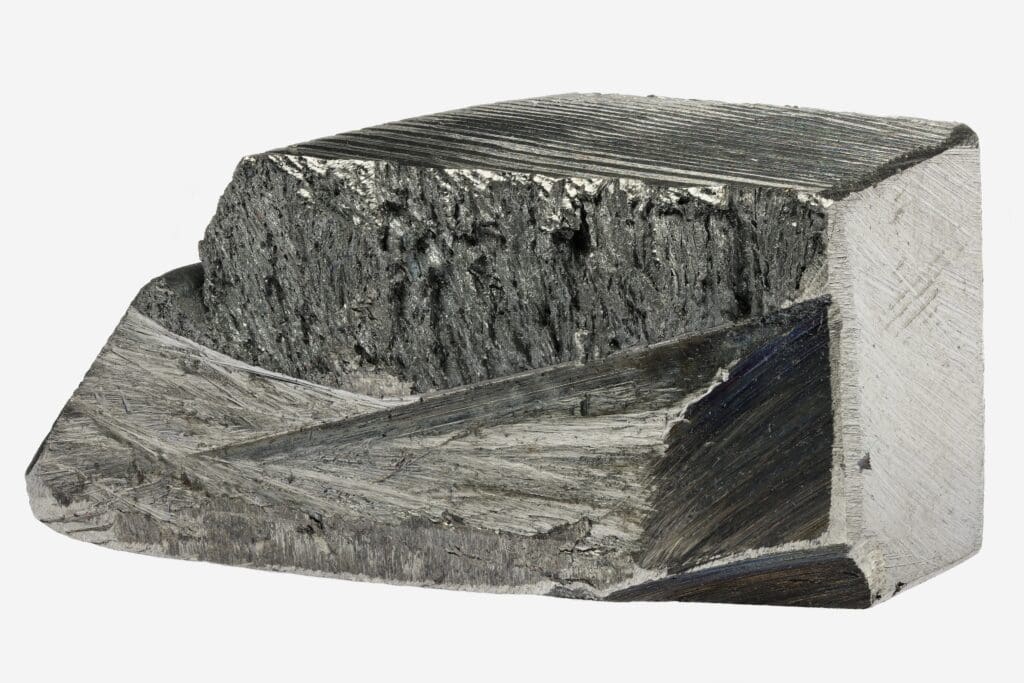

What Are Rare Earth Minerals?

Rare earths comprise 17 metallic elements in the periodic table, including scandium, yttrium, and the lanthanides. Despite their name, these materials are not inherently rare, being more abundant than gold; however, their extraction and processing are complex, costly, and environmentally challenging.

These minerals are indispensable for modern technology, found in products ranging from smartphones, electric vehicle batteries, and LED lights to MRI scanners and cancer treatments. They are also vital for the US military, used in advanced systems like F-35 fighter jets, submarines, lasers, satellites, and Tomahawk missiles, according to a 2025 research note from CSIS.

China’s Dominance in Production and Processing

China accounts for 69% of global mined rare earth production and controls an estimated 92% of the world’s processing capacity. The United States, despite having some domestic deposits, notably lacks the capability to separate heavy rare earths after extraction, historically sending them to China for processing.

Gracelin Baskaran, director of the Critical Minerals Security Program at the Center for Strategic and International Studies, highlighted that China has demonstrated a willingness to “weaponize” America’s reliance on its rare earth separation capabilities. The US currently operates one rare earth mine in California.

Escalation in the Trade War

President Trump publicly responded to China’s latest restrictions on Truth Social, stating he would be “forced, as President of the United States of America, to financially counter their move.” He also asserted that for “every Element that they have been able to monopolize, we have two.”

The United States’ substantial dependence on China for these materials underscores the impact of these controls. Between 2020 and 2023, approximately 70% of US imports of rare earth compounds and metals originated from China, according to a U.S. Geological Survey report.

The recent actions by Beijing mark a significant intensification of the trade tensions between the world’s two largest economies, with rare earth minerals serving as a critical point of leverage and contention.