Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

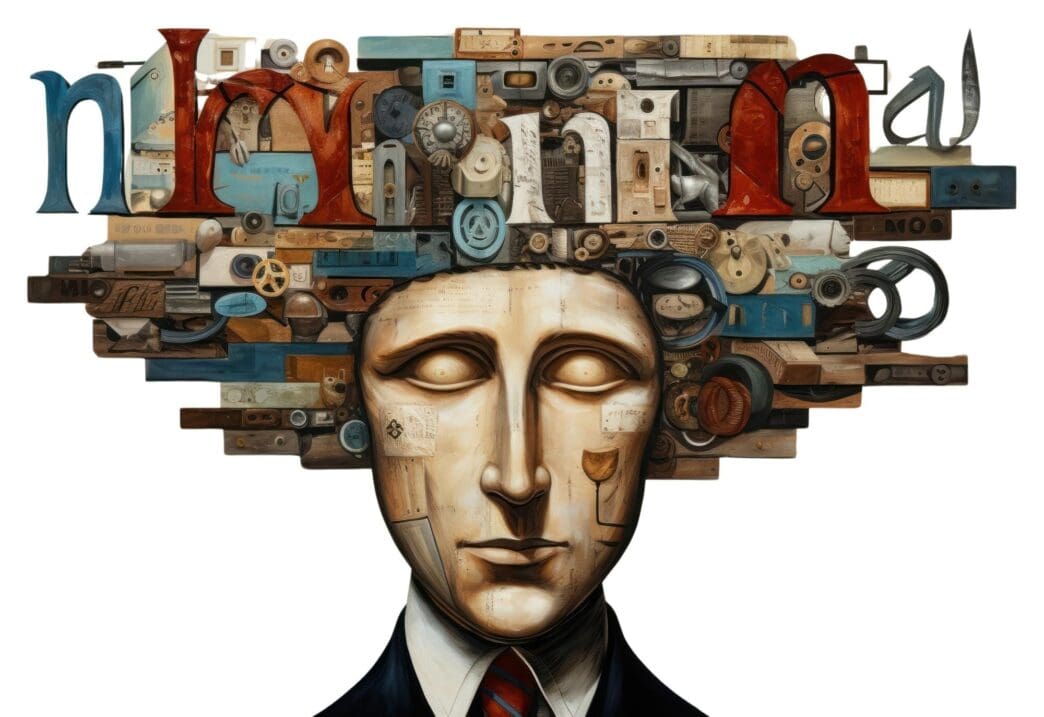

Charlie Munger, the late visionary investor and long-time business partner of Warren Buffett, fundamentally revolutionized how smart money approaches business strategy through his unwavering advocacy for mental models. These sophisticated frameworks, drawn from diverse academic disciplines, equip leaders to make more rational decisions, understand complex market dynamics, and cultivate robust competitive advantages, ultimately steering businesses toward sustainable growth and superior performance. By adopting Munger’s interdisciplinary approach, executives and entrepreneurs can unlock deeper insights into challenges and opportunities, moving beyond conventional wisdom to build more resilient and prosperous enterprises.

Who Was Charlie Munger?

Charlie Munger was an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway. For decades, he was Warren Buffett’s right-hand man, a partnership that transformed a struggling textile company into one of the world’s most successful conglomerates. Munger was celebrated not just for his investment acumen, but for his profound intellectual curiosity and his unique, multidisciplinary approach to problem-solving.

Often described as the “idea man” behind Berkshire Hathaway’s success, Munger believed in synthesizing knowledge from various fields to gain a comprehensive understanding of the world. His philosophy emphasized the importance of a “latticework of mental models” to navigate complex business and investment landscapes. This intellectual framework became a cornerstone of Berkshire’s legendary decision-making process.

What Are Mental Models?

Mental models are simply frameworks or lenses through which we view and interpret the world. They are conceptual tools that help us understand how things work, predict outcomes, and make better decisions. Rather than relying on intuition or narrow expertise, mental models provide a structured way to analyze situations, identify underlying causes, and foresee potential consequences.

These models are powerful because they distill complex realities into understandable principles, allowing for clearer thinking and more effective action. They help us avoid common cognitive biases and logical fallacies that often plague human judgment. By consciously applying a diverse set of mental models, individuals can significantly enhance their analytical capabilities and strategic foresight.

The Latticework of Mental Models

Munger famously advocated for developing a “latticework of mental models,” meaning one should acquire a broad range of models from different disciplines and connect them. He believed that true understanding comes from seeing how principles from psychology, economics, physics, biology, and history intersect and apply to a given problem. This interdisciplinary approach prevents tunnel vision and encourages a holistic perspective.

Building this latticework requires continuous learning and a voracious appetite for knowledge across various fields. It’s about more than just memorizing facts; it’s about understanding fundamental principles and how they interact. This integrated knowledge base allows for a more robust and nuanced analysis of business challenges and opportunities.

Key Mental Models for Business Strategy

While Munger never published a definitive list, several mental models frequently appeared in his discussions and are highly applicable to business strategy. Incorporating these into your strategic thinking can provide a significant competitive edge.

Inversion

The principle of inversion, often summarized as “always invert, always invert,” suggests that instead of trying to achieve a desired outcome, you should consider what would lead to the opposite, undesirable outcome and then avoid those pitfalls. This approach helps identify and mitigate risks that might otherwise be overlooked. For example, rather than asking “How can I make my business succeed?”, ask “What actions would guarantee my business fails?”

In business, inversion can be applied to product development by asking what would make a product undesirable, or to marketing by identifying what would alienate customers. By focusing on what to avoid, companies can build more robust strategies and minimize catastrophic errors. This preemptive problem-solving is a hallmark of Munger’s pragmatic thinking.

Opportunity Cost

Opportunity cost is the value of the next best alternative that was not taken when a decision was made. Every choice involves a trade-off, and understanding what you are giving up is crucial for rational decision-making. This model reminds strategists that resources are finite, and allocating them to one project means foregoing another potentially valuable endeavor.

For a business, investing in a new factory might mean foregoing a significant marketing campaign or research and development into a new product line. Recognizing these hidden costs allows leaders to evaluate choices more comprehensively. It pushes decision-makers to weigh not just the direct costs and benefits, but also the foregone benefits of alternative paths.

Margin of Safety

A core concept in value investing, the margin of safety means buying an asset or undertaking a project only when its market price or expected cost is significantly below its intrinsic value. This buffer provides protection against adverse events, errors in judgment, or unforeseen market fluctuations. It’s about building resilience into every decision.

In business strategy, this translates to conservative financial planning, maintaining strong balance sheets, and avoiding excessive leverage. It also means not overpaying for acquisitions or overestimating future growth prospects. A robust margin of safety ensures that a business can withstand unexpected shocks and continue to operate effectively.

The Power of Incentives

Munger often stated, “Show me the incentive and I will show you the outcome.” This model highlights that human behavior is largely driven by incentives, both explicit and implicit. Understanding and designing effective incentive structures is paramount for motivating employees, aligning organizational goals, and influencing customer behavior.

Businesses must carefully consider how their compensation plans, performance metrics, and cultural norms incentivize certain actions. Misaligned incentives can lead to unintended consequences, ethical lapses, or a focus on short-term gains over long-term value. Designing systems that reward desired behaviors is critical for strategic execution.

Psychological Biases

Munger extensively studied human psychology, recognizing that cognitive biases frequently impair rational decision-making. Biases like confirmation bias (seeking information that confirms existing beliefs), overconfidence, social proof (following the crowd), and availability bias (overestimating the likelihood of events based on recent examples) can lead to poor strategic choices. Recognizing these biases in oneself and others is the first step toward mitigating their impact.

By understanding common psychological traps, leaders can implement processes to counteract them, such as seeking diverse opinions, challenging assumptions, and relying on data rather than gut feelings. This critical self-awareness is essential for making objective and well-reasoned strategic decisions.

Scale Economies

Economies of scale refer to the cost advantages that enterprises obtain due to their scale of operation. As a company produces more, the average cost per unit often decreases, giving larger firms a competitive advantage. This model is crucial for understanding industry structures and identifying potential competitive moats.

Businesses that can achieve significant economies of scale, whether through manufacturing, distribution, or technology, often enjoy lower costs, higher profit margins, and greater pricing power. Strategic decisions around market entry, growth, and consolidation should always consider the role of scale in achieving sustainable profitability.

Moats (Competitive Advantages)

Inspired by Warren Buffett’s analogy, a “moat” refers to a sustainable competitive advantage that protects a company’s long-term profits and market share from competitors. These moats can take various forms, including strong brands, network effects, cost advantages, patents, or regulatory protections. Identifying and building these durable advantages is central to long-term business success.

Strategic planning should focus on identifying existing moats and investing in strengthening them, or creating new ones. A business without a clear competitive moat is vulnerable to intense competition and eroding profits. Understanding what makes a business truly unique and defensible is a core Mungerian insight.

Implementing Mental Models in Your Business

To effectively leverage mental models, cultivate a culture of continuous learning and intellectual curiosity within your organization. Encourage leaders and employees to read widely across various disciplines, not just business books. Foster an environment where challenging assumptions and seeking diverse perspectives are valued.

Practice applying different models to real-world business problems and case studies. Regularly review decisions, using mental models to analyze what went right or wrong. This iterative process of learning and application will gradually build a robust “latticework” that enhances strategic thinking and decision quality across the board.

The Long-Term Advantage

Adopting Charlie Munger’s approach to mental models offers a profound long-term advantage for any business. It moves strategic thinking beyond superficial trends and into a realm of fundamental principles, fostering a deeper understanding of cause and effect. This leads to more resilient strategies, better resource allocation, and a greater capacity for adapting to unforeseen changes in the market.

By integrating this multidisciplinary perspective, businesses can make more informed choices, avoid common pitfalls, and ultimately build more durable and successful enterprises. Munger’s legacy reminds us that true wisdom in business comes from a broad, integrated understanding of how the world truly works.