Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

Gold has significantly outperformed the broader stock market in 2025, triggering renewed debate among prominent investors Warren Buffett and Ray Dalio regarding the precious metal’s role in a portfolio. As of early November, gold has surged by 48% year-to-date, far exceeding the S&P 500 index’s 17% gain, highlighting a stark contrast in investment philosophies.

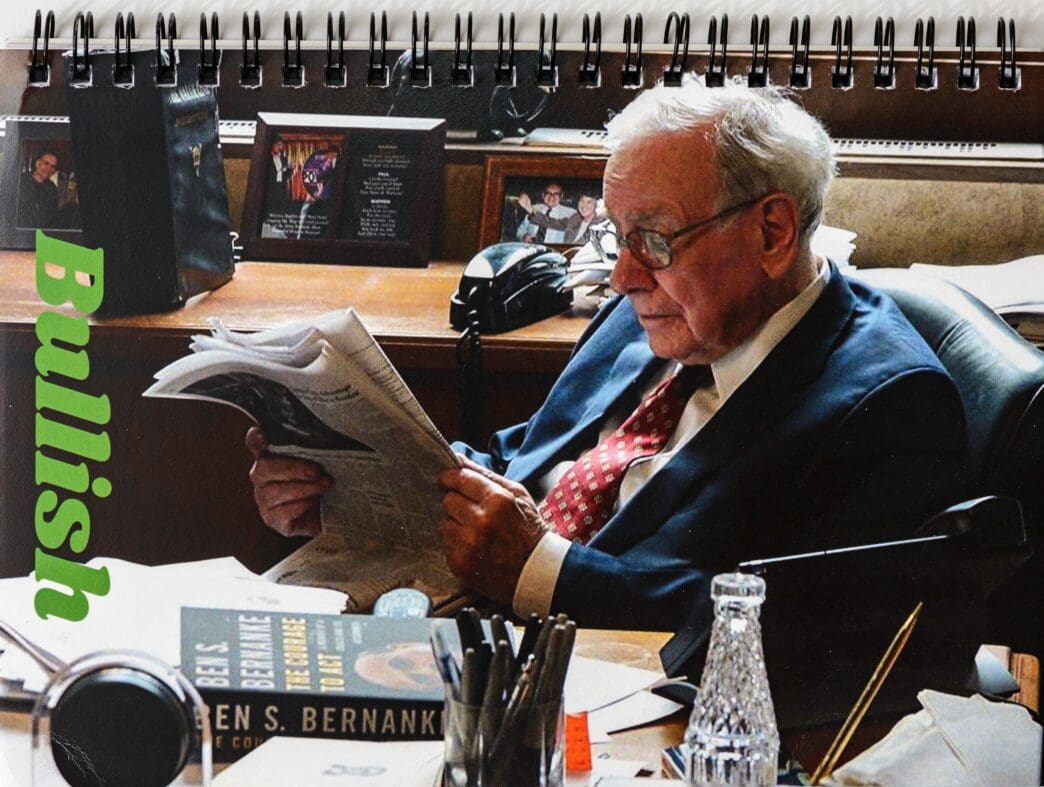

Buffett’s Stance on Gold as an “Unproductive” Asset

Warren Buffett, chairman and CEO of Berkshire Hathaway, has consistently viewed gold as an “unproductive” asset throughout his career. In his 2011 letter to shareholders, Buffett outlined two primary shortcomings: its limited utility and its inability to generate revenue or earnings.

Buffett noted that gold’s main uses are in jewelry and certain semiconductor applications, neither of which creates enough demand to absorb new supply. He emphasized that an ounce of gold today will remain an ounce a century from now, producing no additional value. For the estimated $28 trillion total value of above-ground physical gold, Buffett suggests an investor could instead acquire companies like Nvidia, Microsoft, and Apple more than twice over, which generate goods and services, capital growth, and dividends for shareholders.

Dalio’s Advocacy for Gold as a Store of Value

Conversely, Ray Dalio, founder of Bridgewater Associates, advocates for including gold in investment portfolios, especially given current economic conditions. Dalio, a student of economic history, expresses concern over what he perceives as reckless government spending in the U.S. and the escalating national debt.

With the U.S. national debt surpassing $38 trillion and a fiscal 2025 budget deficit of $1.8 trillion, Dalio draws parallels to the 1970s, when high inflation and debt eroded confidence in paper currency. He views gold not merely as a metal but as the most established form of money, having served as a store of value for thousands of years. Dalio suggests that a significant increase in the money supply to manage the debt could devalue the dollar, making gold an essential hedge.

Speaking at the Greenwich Economic Forum in October, Dalio recommended that investors consider allocating up to 15% of their portfolios to gold. For practical investment, he highlighted exchange-traded funds (ETFs) such as the iShares Gold Trust (GLD) as viable alternatives to physical gold ownership.

Historical Context and Investor Considerations

The differing views are rooted in the U.S.’s abandonment of the gold standard in 1971, which previously linked the dollar’s value to physical gold reserves. This move allowed for greater flexibility in monetary policy but also removed a historical constraint on money printing.

While gold’s 48% gain in 2025 is notable, its long-term performance has been more modest. Over the past 30 years, gold has generated a compound annual return of 7.96%, trailing the S&P 500’s 10.6% annual return over the same period. This long-term trend appears to support Buffett’s perspective on the stock market’s superior wealth creation.

However, proponents of gold argue that in scenarios of severe economic crisis or currency devaluation, the stock market may not be the optimal investment, and gold could provide a crucial hedge. Financial advisors often recommend a more moderate allocation to gold, typically between 5% and 10%, viewing it as a form of portfolio insurance rather than a primary growth driver.

Key Takeaways

The debate between Warren Buffett and Ray Dalio on gold underscores fundamental differences in investment philosophy. While gold’s recent surge highlights its appeal as a safe haven in uncertain times, its long-term performance generally lags equity markets. Investors must weigh gold’s historical role as a store of value against its lack of productive capacity when considering its place within a diversified portfolio.