Executive Summary

- Nobel laureate Michael Spence stressed that restoring confidence and stabilizing China’s property market are significantly more crucial for the nation’s economic recovery than tariffs.

- Spence highlighted the urgent need to protect household balance sheets from further erosion, particularly due to declining property values.

- He asserted that stabilizing the real estate and related financial sectors, along with restoring confidence, is “significantly more important” than the impacts of tariffs on China’s economy.

The Story So Far

- China’s economy is currently grappling with significant domestic challenges, including a prolonged property market downturn, sluggish consumer demand, and deflationary pressures, which have led to an erosion of household balance sheets. These internal structural issues, particularly the stabilization of the real estate and related financial sectors, are deemed more crucial for restoring economic confidence and momentum than external factors like tariffs, especially as the nation prepares for its next five-year planning phase.

Why This Matters

- Nobel laureate Michael Spence’s analysis suggests that China’s economic recovery and long-term stability are fundamentally dependent on stabilizing its embattled property market and restoring domestic confidence, which is more critical than addressing the impact of tariffs. This prioritization aims to protect household balance sheets from further erosion, ensuring broader consumer confidence and financial sector stability as the nation prepares for its next five-year planning phase.

Who Thinks What?

- Nobel laureate Michael Spence emphasizes that restoring confidence and stabilizing China’s embattled property market and related financial sector, along with protecting household balance sheets, are significantly more crucial for the nation’s economic recovery.

- Spence considers external factors like tariffs to be of secondary importance to reigniting the Chinese economy, despite acknowledging they need serious attention from Beijing.

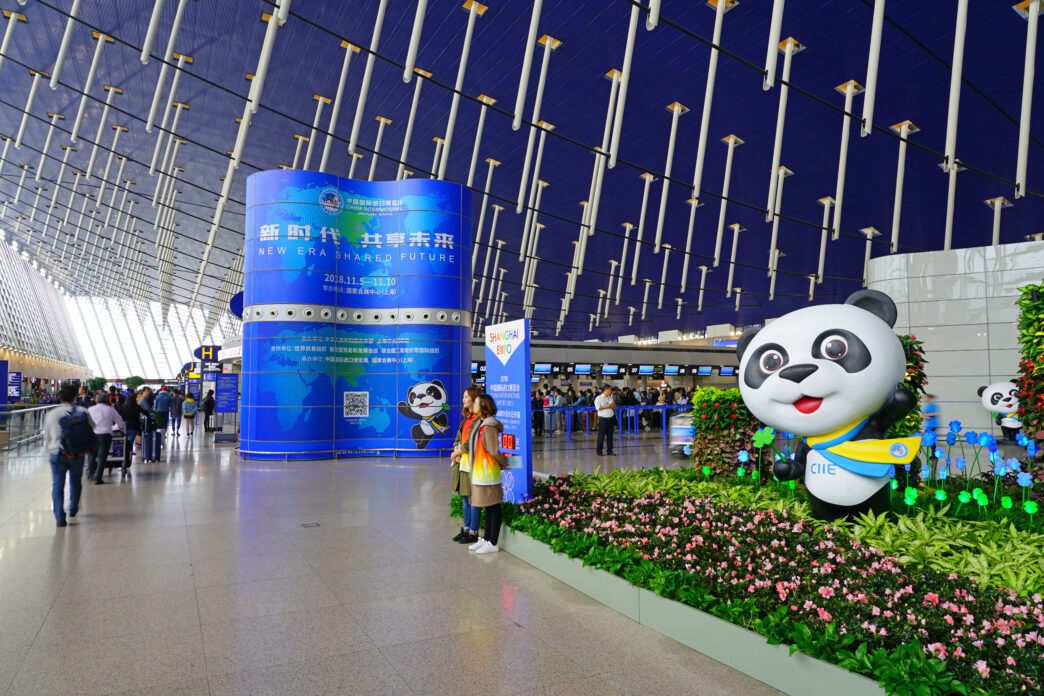

Nobel laureate Michael Spence emphasized that restoring confidence and stabilizing China’s embattled property market are significantly more crucial for the nation’s economic recovery than the impact of tariffs. Speaking at the Hongqiao International Economic Forum in Shanghai on Thursday, Spence highlighted the urgent need to protect household balance sheets from further erosion, especially as China anticipates its next five-year planning phase.

Prioritizing Domestic Stability Over Trade Frictions

Spence, who received the Nobel Prize in economics in 2001 and is a professor emeritus at Stanford University, asserted that external factors like tariffs, while needing serious attention from Beijing, are of “secondary importance” to reigniting the Chinese economy. He explicitly stated that “stabilisation of the real estate sector, the financial sector that’s related to it, [and] restoring confidence and momentum are significantly more important than whatever impacts the tariffs are having.”

These remarks come as the world’s second-largest economy prepares for its 15th five-year phase, spanning 2026 to 2030. This period is expected to test Beijing’s economic policymaking amid persistent external risks, including ongoing tensions with the United States, and significant domestic headwinds such as sluggish consumer demand, a prolonged property market downturn, and deflationary pressures.

During the high-level forum, which runs concurrently with the China International Import Expo, Spence reiterated the critical necessity for China to safeguard household balance sheets. He noted that these have already faced erosion, partly due to declining property values, underscoring the interconnectedness of the real estate sector with broader consumer confidence and financial stability.

Key Economic Takeaways

Ultimately, Spence’s analysis underscores a critical perspective for China’s economic future: that internal structural issues, particularly within the property market and consumer confidence, demand more immediate and strategic attention than external trade frictions to ensure long-term stability and growth.