Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

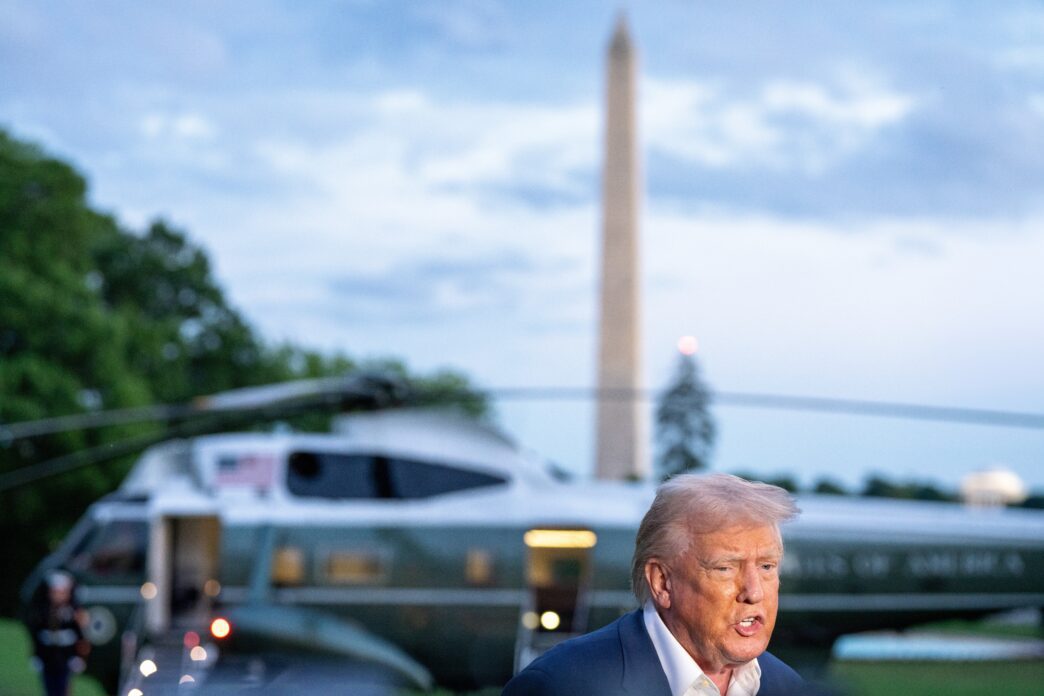

President Donald Trump has proposed distributing $2,000 tariff rebate checks to Americans, excluding high-income earners, as a means to address affordability concerns. The proposal, shared on Truth Social, suggests funding these payments from the substantial tariff revenue collected by the U.S. government. However, the feasibility of such a plan faces significant financial, legal, and congressional hurdles, including questions about available funds and the need for legislative approval.

Proposal Details

Trump’s suggestion follows previous mentions of returning tariff revenue to citizens, arguing that while importers initially pay tariffs, these costs are often passed to consumers, making Americans indirectly responsible. Unlike pandemic-era stimulus checks funded by general taxpayer funds, Trump’s plan aims to use money specifically collected from tariffs imposed on imported goods.

Official Reactions

Treasury Secretary Scott Bessent expressed a noncommittal view on the proposal, noting that no formal plans for distributing tariff revenue have been made. Bessent suggested that any $2,000 payment “could come in lots of forms,” potentially including tax relief rather than direct checks.

In a social media post, Trump stated that any remaining tariff income after rebates would be used to “SUBSTANTIALLY PAY DOWN NATIONAL DEBT.” An unnamed White House official affirmed the administration’s commitment to “putting this money to good use for the American people.”

Financial Feasibility

The U.S. Treasury has collected over $220 billion in tariff revenue. A rough estimate for 163 million tax filers receiving $2,000 each totals approximately $326 billion, a sum that surpasses the currently collected tariff funds. Trump’s plan to exclude wealthy Americans lacks a clear income cutoff to bridge this financial gap.

Legal and Congressional Hurdles

The Supreme Court is currently reviewing the Trump administration’s use of emergency powers to impose certain tariffs, which account for about $100 billion of the total revenue. A ruling against the administration could necessitate returning these funds to businesses, significantly reducing the pool available for citizen rebates.

Furthermore, the U.S. Constitution grants Congress the “power of the purse,” meaning any such rebate program would almost certainly require legislative approval. It remains uncertain whether Trump could garner sufficient support in Congress for this initiative.

Potential Economic Impact

While past stimulus checks have been popular during economic downturns, the current economy is not in recession. Critics suggest that issuing new rebate checks could fuel inflation, a primary concern for many Americans, and potentially prompt the Federal Reserve to raise interest rates to counteract rising prices. This could also face opposition from fiscal conservatives within Trump’s own party.

Implementation Timeline

Should the proposal advance, the distribution timeline for checks could vary significantly. During the pandemic, direct deposits were processed within approximately a week, while paper checks took around 20 weeks to reach recipients.

Outlook

The proposal for $2,000 tariff rebate checks, while aimed at alleviating affordability issues, presents a complex financial and political challenge. Its implementation would depend on overcoming budget shortfalls, navigating potential Supreme Court rulings, and securing congressional backing, alongside careful consideration of its broader economic effects.