Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

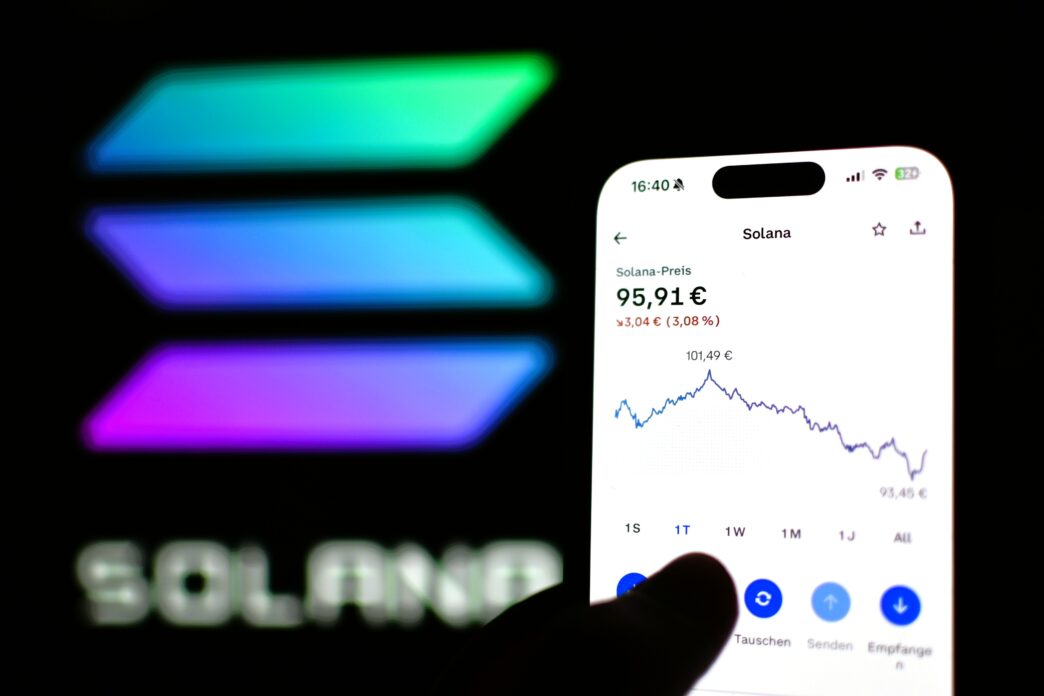

Solana (SOL) is currently hovering near critical support levels, with its price recovering slightly to $142.27 at press time, despite a significant weekly decline of nearly 16%. Analysts are closely monitoring technical indicators and key price thresholds to determine the asset’s next directional move after a volatile trading period.

TD Sequential Signals Potential Rebound

Crypto analyst Ali Martinez identified a fresh TD Sequential buy signal on Solana’s 12-hour chart. This indicator, often appearing near market exhaustion points, flashed its signal after a completed red nine count, suggesting a potential short-term rebound attempt.

Solana is stabilizing near the $136–$139 support band, a zone that has previously cushioned pullbacks and attracted buyers. Martinez indicates that a sustained break above $142 would confirm upward momentum, while failure to hold the lower boundary could expose further downside targets at $131 and potentially $126.

Elliott Wave Outlook and Crucial Thresholds

Further technical analysis from “Man of Bitcoin” highlights the broader Elliott Wave roadmap, which hinges on the $127 level. Maintaining price action above this threshold keeps a bullish “white scenario” valid.

A breakdown below $127 could open deeper ranges aligned with extended Fibonacci projections, potentially targeting areas around $117 and $106. Current price action is also drifting toward the 0.786 and 0.887 Fibonacci region, a dense support band between $146 and $136 that has previously seen strong reactions.

High-Volume Zones to Dictate Next Move

CryptoPulse’s weekly perspective indicates that Solana is currently testing its first major high-volume support zone, spanning between $135 and $145. A deeper, more significant zone lies between $118 and $126.

A sweep of this lower area could reset Solana’s market structure, potentially setting the stage for a stronger rally. These high-volume zones have historically acted as major trend pivots in earlier market cycles.

Outlook

Despite a slight daily gain, Solana’s price remains under significant weekly pressure. The confluence of TD Sequential buy signals, critical Elliott Wave thresholds, and high-volume support zones suggests a pivotal moment for the asset, with market participants closely watching whether buyers can regain control and prevent further declines.