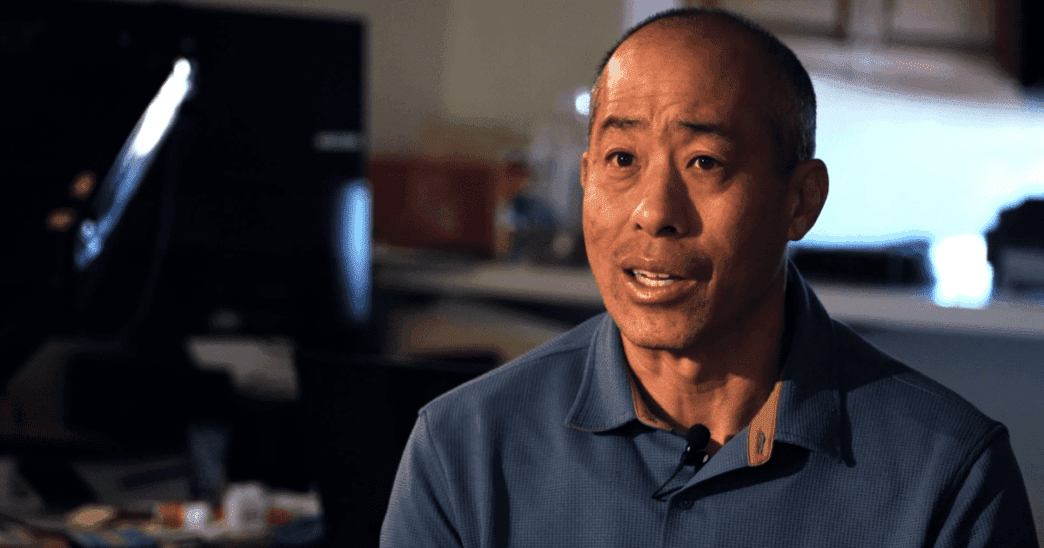

A resident of Carlsbad, California, fell victim to a SIM-swapping scam, resulting in a loss of $38,000 from his bank account. Justin Chan, the victim, recounted that his iPhone displayed unexpected notifications, leading to the discovery of the scam.

Justin Chan realized something was amiss when his iPhone disconnected from the cellular network. Suddenly, he was unable to make or receive calls, with his phone showing an ‘SOS’ notification instead of the usual signal bars. This peculiar occurrence signified that his phone number had been compromised through SIM swapping.

SIM swapping, a tactic where scammers trick phone carriers into switching a victim’s phone number to a new SIM card, allowed the perpetrator to access Chan’s sensitive accounts. The fraudster deceived Xfinity Mobile by providing the last four digits of Chan’s credit card as validation. Chan expressed disbelief, questioning the validity of such verification methods.

A week after the network anomaly, Chan received correspondence from Bank of America. To his shock, three unauthorized wire transfers totaling $38,000 had been executed while he slept. Notably, one significant transfer of $20,000 was directed to a Wells Fargo account. Scripps News San Diego uncovered that the account beneficiary’s identity aligns with a convicted felon in Sacramento.

Despite notifying the Carlsbad police and Bank of America about the fraudulent transactions, Chan faced further disappointment. Bank of America rejected his fraud claim, stating that the transactions had been verified by him via SMS text messages. This assertion left Chan feeling as wronged by the bank as by the scammer.

The FBI disclosed to Scripps News San Diego that there have been approximately 800 reported SIM-swapping incidents across the nation this year, with the actual figure likely being higher due to underreporting. FBI analyst David Tomasz highlighted the significant financial impact, with such crimes costing victims over $48 million last year.

Tomasz explained that scammers often gather personal details, like addresses or other identifiable information, to bypass security checks. Once they gain control over a phone number, fraudsters can easily access bank accounts and intercept two-factor authentication codes, elevating their potential for financial theft.

If detected early, law enforcement can initiate a ‘financial kill chain’ to freeze the funds. However, recovery becomes increasingly unlikely with time, especially for victims of cryptocurrency theft, due to its rapid and untraceable nature.

To safeguard personal accounts, Melissa Lambarena, a personal finance expert, advises maintaining unique passwords and setting a PIN with phone carriers to confirm any account changes. Xfinity Mobile is reportedly addressing the issue raised by Chan, implementing Federal Communications Commission guidelines to combat SIM-swapping scams.

Although Bank of America’s investigation remains open, the bank has yet to decide on refunding Chan. Bank representatives emphasized their commitment to protecting clients and addressing legitimate fraud claims.

Chan has shared his ordeal to raise awareness about SIM-swapping scams and prevent others from suffering similar losses. He stresses that such a crime could happen to anyone, urging vigilance and proactive measures to protect personal data.

Source: Abcactionnews