In a revealing account, Desiree Gutierrez shares her journey to overcome $32,000 in credit card debt by employing a straightforward rule called Consumption.

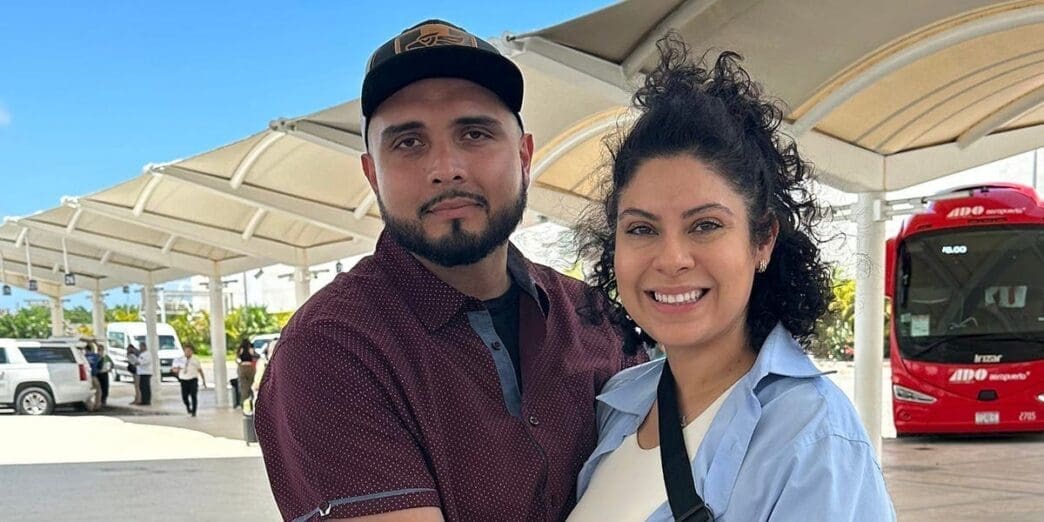

Desiree Gutierrez and her husband found themselves burdened with credit card debt that was nearly five times the average for U.S. households in 2018. Their spending habits and the escalating interest rates were pushing them deeper into financial trouble. Despite both working full-time jobs, they struggled to manage their finances as salaries were not enough to cover daycare costs and student loans.

In early 2019, inspired by the popular Netflix series “Tidying Up with Marie Kondo,” the couple decided to apply a decluttering approach to their finances. They set a New Year’s resolution to manage their spending through a method they called Consumption. This simple yet effective game involved curbing purchases until existing supplies were fully utilized. The principle extended to everyday items; for instance, new lotion and cosmetics were not bought until the existing ones were completely used.

Desiree noted that their income was about $4,000 a month, with nearly half previously spent on non-essential items. The Consumption game revealed that they could allocate an extra $100 monthly to pay down their debt. Social media played a key role, serving as an accountability partner where Desiree shared progress updates, which helped maintain focus and reduce impulsive spending influenced by online influencers.

The journey to financial freedom included paying off the smallest credit card balance first, known as the snowball effect, a strategy advocated by financial expert Dave Ramsey. By spring 2019, they had eliminated their smallest debt and continued tackling larger balances. By 2021, Desiree and her family were completely debt-free.

Today, they live with a more mindful approach to spending. The family now boasts an emergency fund, savings accounts, and a plan for an early mortgage payoff. They continue to prioritize financial stability, which is evident in their regular savings and investments. Desiree also managed to graduate without student loans, having covered tuition through cash, grants, and scholarships. The feeling of financial liberation has positively impacted their quality of life, leading to a more balanced and stress-free existence.

Desiree Gutierrez’s story is a powerful example of how intentional lifestyle changes and a strategic approach to debt can lead to lasting financial peace. Her commitment to the Consumption rule and subsequent debt elimination highlights a path others might consider when facing similar challenges.

Source: Businessinsider