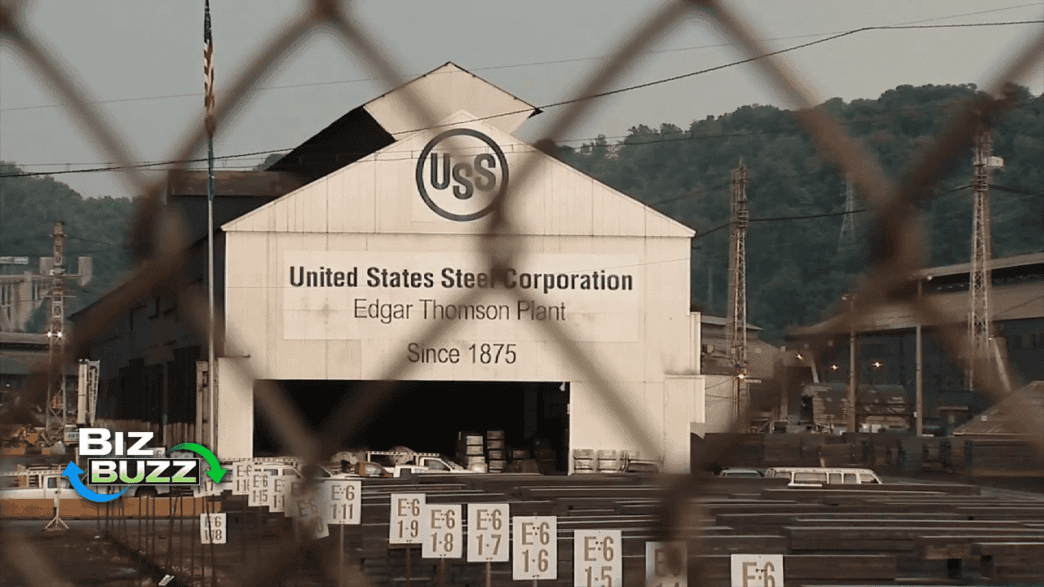

Nippon Steel and U.S. Steel have initiated legal proceedings against the Biden administration following the blockage of a $15 billion acquisition deal. This acquisition, which involved purchasing a Pittsburgh-based steel company, has been halted due to national security concerns highlighted by President Biden.

In recent legal filings, both Nippon Steel and U.S. Steel argue that the decision to block the acquisition lacked a rational legal basis and was politically motivated. The lawsuits, filed in the U.S. Court of Appeals for the District of Columbia and the U.S. District Court for the Western District of Pennsylvania, accuse the administration of prioritizing political objectives over a genuine security threat. Furthermore, Nippon pledged substantial investments of $2.7 billion into aging steel operations in Indiana and Pennsylvania, ensuring no reduction in production capacity without U.S. approval. Despite these commitments, President Biden emphasized the importance of a strong domestic steel industry to national security, marking this as the first instance where a merger between U.S. and Japanese firms was obstructed by a U.S. president.

The Committee on Foreign Investment in the United States (CFIUS) played a significant role, having failed to reach a consensus on potential national security risks, which triggered a presidential review. The companies contend that CFIUS was discouraged from engaging in meaningful dialogue or proposing alternatives, suggesting a pre-determined outcome aligned with political motives.

Additionally, Nippon and U.S. Steel have accused Cleveland-Cliffs, their industry rival, and the United Steelworkers union of engaging in anti-competitive practices. Cleveland-Cliffs’ CEO, Lourenco Goncalves, is alleged to have collaborated with union head David McCall to obstruct Nippon’s acquisition, aiming to preserve Cleveland-Cliffs’ bid, which had been previously rejected by U.S. Steel.

This legal battle is unfolding as President Biden approaches the end of his term, with President-elect Donald Trump signaling continued opposition to the merger. Trump has articulated plans to reinforce U.S. Steel through tariffs and tax incentives, further challenging the feasibility of the acquisition. In a post on Truth Social, Trump questioned the timing of any potential sale, given the anticipated profitability of U.S. Steel under his proposed economic policies.

Amidst these developments, shares of United States Steel Corp have experienced a slight increase, rising by over 4% in pre-market trading. The unfolding litigation and political maneuvers underscore the complex interplay of business interests and national security considerations in the global steel industry.

The lawsuit filed by Nippon and U.S. Steel against the U.S. government represents a significant clash between international business aspirations and domestic policy priorities. As this legal battle progresses, it highlights the intricate balance between fostering global economic partnerships and safeguarding national interests.

Source: Wsvn