In the dynamic economic landscape of South Florida, keeping track of the Consumer Price Index (CPI) becomes crucial for businesses and individuals alike. As we delve into the CPI for the region (Miami – Fort Lauderdale – West Palm Beach) in the years 2021, 2022 and 2023, we will explore its significance, its effects on local businesses, and what we can expect for the CPI in 2024 and beyond.

1. What is the CPI?

The CPI is a widely used economic indicator that measures changes in the average prices paid by urban consumers for a basket of goods and services. It provides valuable insights into the inflation trends in an economy, allowing businesses and policymakers to gauge the overall cost of living for consumers.

2. The CPI for Miami and South Florida in 2021

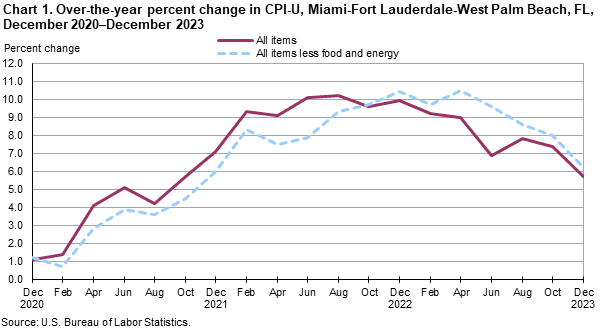

Throughout 2021, South Florida witnessed a notable increase in the CPI. This rise was primarily driven by factors such as pent-up demand, supply chain disruptions, and labor shortages in various sectors. The pandemic-induced challenges, coupled with increased consumer spending, resulted in higher prices for goods and services across the board.

Here is the data showing the Consumer Price Index (CPI) for every two months in 2021:

| Date | Value |

| December 31, 2021 | 293.28 |

| October 31, 2021 | 289.79 |

| August 31, 2021 | 285.47 |

| June 30, 2021 | 284.80 |

| April 30, 2021 | 280.39 |

| February 28, 2021 | 275.85 |

3. The CPI for Miami and South Florida in 2022

As the economy started recovering from the pandemic’s impact, the CPI for Miami and South Florida continued its upward trajectory in 2022. The rebounding tourism industry and the gradual return to pre-pandemic activities led to heightened demand, fueling inflation. Additionally, rising energy costs and the price hikes in essential commodities like food contributed to the overall CPI surge.

Here is the data showing the Consumer Price Index (CPI) for every two months in 2022:

| Date | Value |

| December 31, 2022 | 322.21 |

| October 31, 2022 | 317.62 |

| August 31, 2022 | 314.69 |

| June 30, 2022 | 313.51 |

| April 30, 2022 | 305.96 |

| February 28, 2022 | 301.46 |

4. The CPI for Miami and South Florida in 2023

In 2023, South Florida experienced a stabilization in the CPI growth rate, although it remained at an elevated level. As the economy adjusted to new dynamics post-pandemic, businesses adapted their pricing strategies to the changed market conditions, leading to more controlled price increases. However, ongoing challenges such as wage pressures and supply chain disruptions continued to exert upward pressure on the CPI.

Here is the data showing the Consumer Price Index (CPI) for every two months in 2023:

| Date | Value |

| December 31, 2023 | 340.46 |

| October 31, 2023 | 341.18 |

| August 31, 2023 | 339.35 |

| June 30, 2023 | 335.27 |

| April 30, 2023 | 333.59 |

| February 28, 2023 | 329.06 |

5. How does the CPI affect businesses in the region?

The CPI plays a vital role in shaping the strategies and decision-making processes of businesses in South Florida. By analyzing the CPI data, businesses can evaluate the impact of inflation on their operations, adjust pricing strategies accordingly, and anticipate consumer demand. Understanding the CPI trends enables businesses to make informed decisions regarding cost management, inventory levels, and workforce compensation, ensuring their long-term sustainability.

6. Food and the CPI in South Florida

Food prices are a significant component of the CPI, and South Florida’s CPI is no exception. Fluctuations in food prices, driven by factors such as weather conditions, transportation costs, and global market trends, can influence the overall CPI for the region. By monitoring food-related CPI trends, businesses in the food industry can adjust their pricing structures and optimize supply chains to maintain profitability and meet consumer demands.

7. Energy and the CPI in South Florida

Energy costs significantly impact the CPI in South Florida. As energy prices rise, the cost of producing and transporting goods increases, leading businesses to pass on these expenses to consumers. The CPI serves as a crucial tool for businesses to monitor energy-related inflation and make informed decisions regarding energy-efficient practices and alternative energy sources to mitigate rising costs.

8. All Items Less Food and Energy

The CPI excludes food and energy to obtain a core inflation rate. This measure provides a clearer picture of the inflation trends, excluding the volatility associated with these two sectors. Understanding the core inflation rate helps businesses gauge the underlying inflationary pressures and adjust their pricing strategies accordingly, leading to more effective responses to changing market dynamics.

9. What to Expect in Terms of CPI for 2024

Looking ahead to 2024, the Consumer Price Index for Miami and South Florida is expected to continue its upward trend, albeit with some moderation. Ongoing labor market challenges and supply chain disruptions are likely to continue, which could weigh on businesses and drive up prices. The dynamics of the tourism industry, government policies and the global economic situation will also play an important role in the development of the CPI in 2024.

On a Final Note

With its impact on businesses and individuals, the Consumer Price Index for South Florida holds significant relevance for the region’s economic landscape. By keeping a close eye on the CPI data, businesses can adapt, remain competitive, and make informed decisions. As we move into 2024 and beyond, businesses must navigate the challenges posed by inflation to ensure their continued success in South Florida’s vibrant economy.