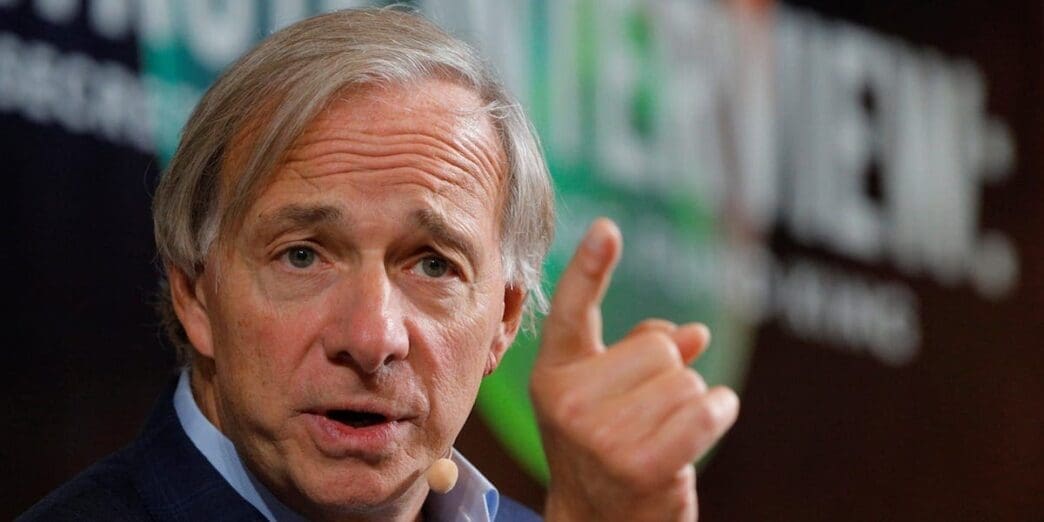

The ongoing tariff policies spearheaded by President Donald Trump are causing significant concern among financial experts, with the founder of Bridgewater Associates, Ray Dalio, highlighting the potential for an economic downturn. Dalio, who previously predicted the 2008 financial crisis, suggests that the current economic strategies could lead the United States towards a recession or possibly a more severe economic scenario if not managed properly.

Dalio emphasizes that the impact of tariffs, coupled with existing debts and geopolitical tensions, poses a substantial risk to the economic stability of the United States. He warns that such factors, if not addressed with caution, may result in severe disruptions to the global economic order. The manner in which these tariffs are implemented will play a crucial role in determining the economic outcome, with Dalio pointing out that the current approach has been significantly disruptive.

President Trump’s tariff measures, intended to bring manufacturing back to the United States and enhance job opportunities and tax revenue, have led to considerable market volatility. Although a 90-day suspension on certain tariffs was announced, it excludes those imposed on China, which now stand at a minimum of 145%. However, certain Chinese electronic products remain exempt from these increased tariffs but still face a 20% levy.

The specter of a recession, characterized by a prolonged period of declining economic activity, looms large. Economists from Goldman Sachs project a 45% probability of a recession occurring within the next year, reflecting the increasing uncertainty surrounding current economic policies. Ray Dalio, with an estimated net worth of $16 billion, remains a vocal critic of these developments, underscoring the need for prudent economic management during these tumultuous times.

The Bigger Picture

The potential repercussions of the current tariff strategy on everyday life could be significant. As concerns about a recession grow, individuals may face increased financial uncertainty. A possible economic downturn might lead to job losses, decreased consumer spending, and a slowdown in business investments, impacting the overall quality of life and financial security for many.

Local businesses, particularly those involved in manufacturing and trade, could experience disruptions due to increased production costs and supply chain challenges. This might result in higher prices for goods and services, further affecting consumer purchasing power. Additionally, global market instability could strain international relations and hinder economic partnerships, ultimately altering the landscape of global trade.

In this context, it becomes crucial for policymakers and industry leaders to navigate these complexities carefully, seeking solutions that stabilize the economy and minimize potential adverse impacts on citizens. The broader economic environment remains highly sensitive to policy decisions, necessitating a balanced approach to ensure sustainable growth and prosperity.