As 2025 approaches, the housing market in the United States is anticipated to tilt in favor of homebuyers, thanks to an expected rise in housing inventory and stable mortgage rates. This shift promises relief for those who have faced affordability issues in recent years.

Real-estate analysts predict a reversal of the extended home sales contraction witnessed in recent years. As inventory increases and mortgage rates stabilize, aspiring homeowners can look forward to a more advantageous buying environment. Lawrence Yun, the chief economist at the National Association of Realtors (NAR), noted, “Homebuyers will have more success next year.” He emphasized the easing of affordability challenges due to increased inventory and stable job and income growth.

Home sales, which have been sluggish following a post-pandemic boom, are expected to rise by 7% to 12% in 2025, reaching 4.5 million units, with a further increase of 10% to 15% in 2026, according to the NAR. New home sales are projected to grow by 11% next year and an additional 8% the following year. This optimism is based on current supply and demand conditions, with a significant increase in property supply noted in recent months.

The NAR also predicts that property prices will grow at a modest rate of 2% annually over the next two years. The median existing-home price is expected to be $410,700. Mortgage rates are projected to decrease to around 6% from the current 7%, potentially allowing 6.2 million households to afford median-priced homes. This stabilization of mortgage rates is critical in alleviating the affordability crisis that peaked after the pandemic, offering buyers new opportunities.

The NAR has identified 10 markets that are expected to stand out in 2025. These markets are characterized by strong property price growth, substantial starter home supplies, positive migration trends, and significant out-of-state buyer interest. Factors such as job growth, mortgage rates, and millennial purchasing power also play crucial roles in these areas.

In Boston, Massachusetts, an anticipated stabilization of mortgage rates may ease inventory constraints. With a 41% share of starter homes and lower mortgage rates compared to national averages, Boston remains a competitive market despite previous price increases.

In Charlotte, North Carolina, a 10% job growth over the last five years bolsters its housing market. With 43% of homes categorized as starter homes, Charlotte remains appealing to first-time buyers, supported by strong migration gains and a youthful demographic moving into prime home-buying age.

Grand Rapids, Michigan offers affordability and strong long-term prospects. With 36% of millennial renters able to afford homes and a steady influx of new residents, it is poised to benefit from the expected reduction in the ‘lock-in effect’ due to rising mortgage rates.

Greenville, South Carolina, stands out for its affordability and high net migration. With a significant supply of starter homes and lower-than-average mortgage rates, Greenville provides a stable environment for families and young professionals.

Hartford, Connecticut offers one of the most favorable financing environments with low mortgage rates, potentially increasing local inventory and alleviating supply constraints.

Indianapolis, Indiana continues to attract new residents with strong job growth and housing affordability, making it a viable market for first-time buyers and young families.

Kansas City, crossing Missouri and Kansas, combines affordability with favorable financing conditions, enhancing its appeal to millennial renters ready for homeownership.

Knoxville, Tennessee’s strong migration gains and high homeownership rates make it a market with significant potential, driven by substantial wealth gains for homeowners.

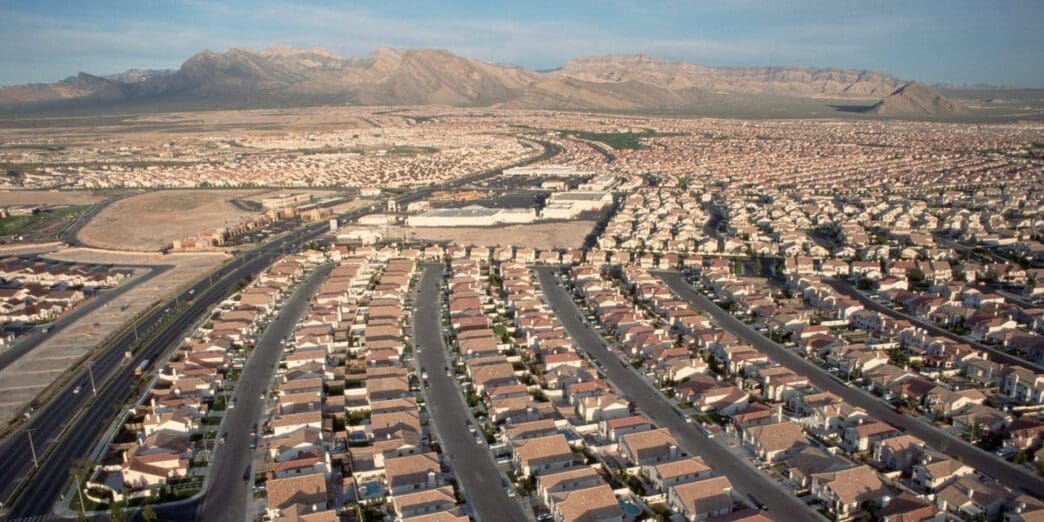

Phoenix, Arizona benefits from migration trends and robust job growth, establishing itself as a dynamic and growing market.

San Antonio, Texas combines strong job creation with favorable mortgage rates below national averages, drawing new residents and sustaining its housing market growth.

The anticipated trends in the housing market for 2025 suggest a more favorable environment for buyers, with an expected increase in inventory and stabilizing mortgage rates. These factors could mark the end of recent affordability challenges, with certain markets poised to see the most significant benefits. As these changes unfold, prospective buyers and homeowners alike will be closely monitoring these developments.

Source: Businessinsider