In today’s complex market, the role of leaders and their political ideologies play critical parts in determining economic outcomes. Data suggest that the duration of right-wing populist leadership correlates with declining equity returns. As populists remain in power, investors seem to exhibit reduced confidence in long-term returns, potentially due to policy unpredictability. Simultaneously, inflation rates tend to rise under both right- and left-wing populists, underscoring challenges in managing economic stability.

When non-populist leaders succeed in elections against populists, data does not show a clear trend regarding equity returns. This lack of clear patterns may reflect market uncertainties or a wait-and-see approach from investors.

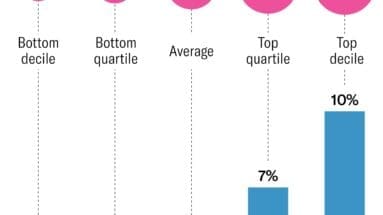

In the sphere of business management, the balance between company needs and employee satisfaction plays a vital role. Enhanced personalization in business strategies corresponds with accelerated growth, indicating that tailor-made approaches could prove beneficial for company performance. However, the modern work environment still faces challenges like employee loneliness despite these innovations.

Additionally, changes in company favorability and commitment scores post-layoffs highlight the long-term costs associated with workforce reductions. Research demonstrates a shift in employee sentiment, indicating that layoffs may detrimentally affect overall organizational morale and productivity.

Furthermore, measuring social impact becomes increasingly important as stakeholders demand transparency and accountability. Businesses are now encouraged to explore comprehensive strategies for evaluating social contributions, ensuring they align with broader societal goals.

In an era where political and business decisions significantly influence economic and social landscapes, it is crucial for leaders to navigate these complexities with informed strategies. The integration of social impact assessments and personalized business approaches will likely guide future economic stability and growth.

Source: HBR