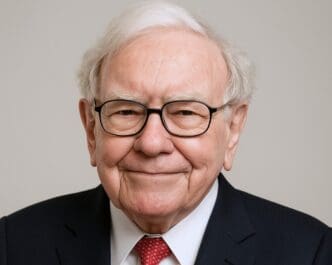

For more than half a century, Warren Buffett, the chairman and CEO of Berkshire Hathaway, has stood as a titan of investing, transforming a failing textile mill into a global conglomerate worth hundreds of billions of dollars. From his headquarters in Omaha, Nebraska, he has built a legendary reputation not on complex algorithms or speculative bets, but on a set of timeless, disciplined principles. For everyday investors seeking to navigate volatile markets and build long-term wealth, understanding Buffett’s playbook is more critical than ever, offering a clear roadmap focused on value, patience, and the fundamental strength of the businesses you own.

The Oracle’s Philosophy: More Than Just Stock Picking

At the heart of Warren Buffett’s strategy is a simple but profound shift in perspective. He does not see stocks as mere ticker symbols to be traded for quick profits. Instead, he views each share as a fractional ownership in a real, operating business. This mindset, inherited from his mentor and the father of value investing, Benjamin Graham, transforms the entire investment process.

Instead of obsessing over daily price fluctuations, Buffett focuses on a company’s long-term earning power, its competitive position, and the quality of its management. His goal is to identify exceptional businesses and acquire them at a sensible price. This approach inherently rejects market timing and the frenetic activity that characterizes much of Wall Street, favoring a patient, deliberate accumulation of quality assets.

This philosophy has evolved over time. While Graham was famous for buying “cigar butts”—deeply undervalued but often mediocre companies with one last puff of value left—Buffett, influenced by his longtime partner Charlie Munger, shifted his focus. He realized it was far better to pay a fair price for a truly wonderful business than to get a bargain on a struggling one. It is this refined approach that defines the modern Buffett playbook.

Buffett’s Top 10 Investing Rules

While his wisdom fills thousands of pages of annual shareholder letters, his core strategy can be distilled into several foundational rules. Here are ten of the most important principles that guide every decision at Berkshire Hathaway.

1. Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1.

This iconic two-part rule is not about avoiding any and all short-term paper losses, which are inevitable. Rather, it is the ultimate statement on the importance of capital preservation. Buffett’s primary focus is on avoiding permanent, catastrophic losses that can result from speculation, overpaying for an asset, or investing in a deteriorating business.

A 50% loss requires a 100% gain just to get back to even, a mathematical reality that highlights the devastating impact of major mistakes. By prioritizing risk management and ensuring a “margin of safety” in every purchase, Buffett builds a foundation that protects his capital, allowing the power of compounding to work its magic over time.

2. Buy Wonderful Companies at a Fair Price

This principle marks Buffett’s crucial evolution from pure value investing to quality investing. He famously stated, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” A wonderful company possesses durable competitive advantages, generates high returns on capital, and is run by able and honest managers.

While a cheap, mediocre business may offer a temporary price pop, a truly great business like Coca-Cola or Apple can compound its value for decades. The goal for investors is to identify these quality enterprises and then wait patiently for an opportunity to buy them at a price that isn’t exorbitant.

3. Understand Your “Circle of Competence”

Buffett has always stressed the importance of staying within what he calls his “circle of competence.” He advises, “Never invest in a business you cannot understand.” This means you should be able to explain, in simple terms, how a company makes money, what its competitive advantages are, and what its future prospects look like.

For many years, this rule kept Buffett away from technology stocks, as he admitted he didn’t understand their business models. His eventual, massive investment in Apple came only after he began to see it not as a tech company, but as a powerful consumer brand with an incredibly sticky ecosystem—a business he could understand. For individuals, this means sticking to industries and companies you know and avoiding the temptation to chase hot stocks in sectors you don’t.

4. Our Favorite Holding Period is Forever

This quote encapsulates Buffett’s long-term horizon. When Berkshire buys a stock, they are not thinking about selling it next quarter or next year. They are buying with the intention of holding it indefinitely, as long as the business remains a high-quality enterprise.

This approach allows investors to fully benefit from the power of compounding, where earnings are reinvested to generate even more earnings. It also minimizes transaction costs and taxes associated with frequent trading. For the average person, this means resisting the urge to react to market noise and instead focusing on the long-term health of the businesses in your portfolio.

5. Price is What You Pay; Value is What You Get

This is perhaps the most succinct definition of value investing. The market price of a stock is simply its last traded price, which can be influenced by emotion, news headlines, and speculation. The intrinsic value, however, is the true underlying worth of the business, based on its future cash flows.

Buffett’s goal is to calculate a conservative estimate of a company’s intrinsic value and then buy the stock only when its market price is significantly lower. This gap between price and value is the “margin of safety.”

6. Be Fearful When Others Are Greedy, and Greedy Only When Others Are Fearful

This is Buffett’s masterclass in contrarian thinking and emotional discipline. Markets are driven by fear and greed, leading to periods of irrational exuberance (bubbles) and excessive pessimism (crashes). The savvy investor uses these emotional tides to their advantage.

When everyone is euphoric and prices are sky-high, it’s a time for caution. Conversely, when panic sets in and investors are dumping quality stocks indiscriminately, it creates immense buying opportunities. Buffett’s major investments in companies like American Express and Goldman Sachs during times of crisis are legendary examples of this rule in action.

7. Demand a Durable Competitive Advantage (a “Moat”)

Buffett looks for companies protected by an “economic moat”—a durable competitive advantage that shields them from competitors, much like a real moat protects a castle. This is the secret sauce of a “wonderful company.”

Moats can come in several forms: a powerful brand (like Coca-Cola), a low-cost business model (like GEICO), network effects (like American Express), or intangible assets like patents and regulatory licenses. A strong moat allows a company to maintain high profitability for many years.

8. Insist on a Margin of Safety

Borrowed directly from Benjamin Graham, the margin of safety is the bedrock of Buffett’s risk management. It is the difference between the estimated intrinsic value of a business and the price you pay for its stock. The wider the margin, the more protected you are.

No one can predict the future with perfect accuracy. The margin of safety provides a buffer against unforeseen problems, errors in judgment, or just plain bad luck. It is the principle that turns investing from a speculative gamble into a prudent enterprise.

9. Focus on Return on Equity (ROE)

While many analysts obsess over quarterly earnings per share (EPS), Buffett pays close attention to a company’s return on equity (ROE). ROE measures how effectively a company’s management is using shareholders’ money to generate profits. It is calculated as Net Income divided by Shareholder’s Equity.

Buffett seeks out businesses that consistently produce high ROE without using excessive debt. A strong and stable ROE is often a sign of a high-quality business with a protective moat.

10. Read, and Think

Buffett famously spends up to 80% of his day reading and thinking. He devours annual reports, industry journals, and newspapers to continuously expand his knowledge and refine his understanding of businesses and markets. This habit is not a quirk; it is central to his success.

For the average investor, the lesson is clear: investing is not a passive activity. Building your circle of competence requires a commitment to lifelong learning. Reading a company’s annual report before buying its stock is a fundamental first step that most investors skip.

Applying the Playbook Today

For most people who lack the time or expertise to analyze individual companies, Buffett has simple advice: regularly buy a low-cost S&P 500 index fund. This strategy aligns perfectly with his principles. It involves buying a diversified cross-section of America’s best businesses, holding them for the long term, and benefiting from the country’s overall economic growth.

Whether you choose to buy index funds or individual stocks, the core lessons from the Buffett playbook remain the same. Success in investing comes not from a secret formula, but from discipline, patience, and a rational framework. By treating stock purchases as business ownership and focusing on quality and value, you can insulate yourself from market hysteria and build a secure financial future.

Ultimately, Warren Buffett’s enduring legacy is his demonstration that investing can be simple, but not easy. The principles are straightforward, but adhering to them in the face of fear and greed is the true challenge. By internalizing his wisdom, any investor can move away from speculation and toward the steady, time-tested path of wealth creation.