Executive Summary

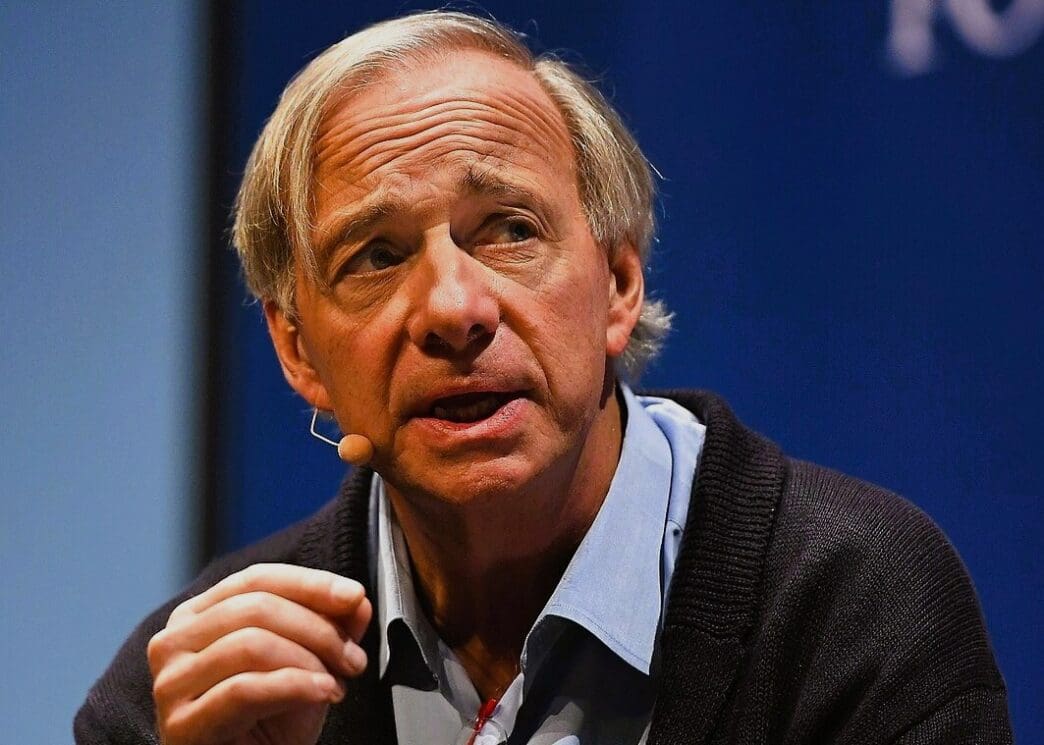

- Billionaire Ray Dalio warned the U.S. is trending towards a 1930s-style autocracy due to increased state intervention, exemplified by the Trump administration’s Intel stake, and growing societal divisions.

- Dalio expressed significant concern over the potential erosion of the Federal Reserve’s independence, cautioning that political pressure to maintain low interest rates would undermine confidence in the dollar.

- Christine Lagarde, President of the European Central Bank, echoed Dalio’s warnings, stating that Trump influencing the Fed’s interest rate decisions would pose a “very serious danger” to global economies.

The Story So Far

- Billionaire Ray Dalio’s warnings arise from a perceived trend towards increased state intervention in the private sector, exemplified by the Trump administration’s actions, and deepening societal divisions that are fostering “more extreme” policies and eroding public trust. These concerns are further compounded by significant political pressure, notably from Donald Trump, on the Federal Reserve, which threatens its independence and the stability of the dollar and global economy.

Why This Matters

- Billionaire Ray Dalio’s warnings highlight a growing concern that increased state intervention and deepening societal divisions in the U.S. could foster autocratic tendencies, potentially leading to more extreme policies and a weakening of democratic norms. Crucially, the erosion of the Federal Reserve’s independence, particularly under political pressure from President Trump, risks undermining confidence in the dollar and U.S. debt, which could destabilize both the American and global economies.

Who Thinks What?

- Billionaire Ray Dalio warns that the United States is trending towards a 1930s-style autocracy due to increased state intervention and growing societal divisions, also expressing concern over potential threats to the Federal Reserve’s independence.

- Donald Trump has been critical of the Federal Reserve’s high interest rates and has reportedly sought to remove a Governor, indicating a desire for political influence over monetary policy.

- Christine Lagarde, President of the European Central Bank, believes that if Trump were to influence the Fed’s interest rate decisions, it would pose “a very serious danger” to both the American and global economies.

Billionaire Ray Dalio, founder of Bridgewater Associates, has warned that the United States is trending towards a 1930s-style autocracy, citing increased state intervention in the private sector and growing societal divisions. His comments, made in a wide-ranging interview with the Financial Times published Tuesday, highlight concerns over the nation’s political and economic trajectory, including potential threats to the Federal Reserve’s independence.

Dalio’s Autocracy Warning

Dalio drew parallels between current political and social developments in the U.S. and events of the 1930s and 1940s globally. He suggested that state intervention, such as the Trump administration’s recent acquisition of a 10% stake in struggling chipmaker Intel, exemplifies the “strong autocratic leadership” that can emerge from a desire to control financial and economic situations.

The hedge fund founder has previously voiced criticism of President Donald Trump’s policies. In June, Dalio opposed Trump’s “One Big Beautiful Bill Act,” arguing that the burgeoning government debt was approaching a critical threshold that could jeopardize the stability of the global economy’s largest player.

According to Dalio, widening gaps in wealth and values, coupled with a decline in public trust, are fueling “more extreme” policies within the U.S. He noted that during such periods, “most people are silent because they are afraid of retaliation if they criticize,” a classic symptom of weakening democracies and rising autocratic leadership driven by a populace seeking government control.

Threats to Federal Reserve Independence

A significant concern raised by Dalio is the potential erosion of the Federal Reserve’s independence. He cautioned that if the central bank were to succumb to political pressure to maintain low interest rates, it would “undermine the confidence in the Fed defending the value of money and make holding dollar-denominated debt assets less attractive.”

Dalio observed that international investors have already begun shifting their investments from U.S. Treasuries to gold, indicating a potential loss of confidence in dollar-denominated assets. This shift aligns with his warnings about the implications of a politicized monetary policy.

For months, Trump has been vocal in his criticism of the Federal Reserve for keeping borrowing costs high in its efforts to combat inflation, and has reportedly sought to remove Governor Lisa Cook. These actions underscore the political pressure the central bank currently faces.

International Concerns Echoed

Dalio’s comments regarding the Fed’s independence are echoed by other prominent financial figures. Christine Lagarde, President of the European Central Bank, recently warned that if Trump were to influence the Fed’s interest rate decisions, it would pose “a very serious danger” to both the American and global economies.

Lagarde emphasized in a radio interview that a U.S. monetary policy no longer independent and instead “depended on the dictates of this or that person” would create a “very worrying” equilibrium for the American economy, with worldwide repercussions given its global dominance.

The warnings from financial leaders like Ray Dalio and Christine Lagarde underscore a growing apprehension about the United States’ political direction and its potential economic consequences. Concerns center on the rise of autocratic tendencies, the impact of deepening societal divisions, and the critical importance of maintaining the Federal Reserve’s autonomy to ensure economic stability both domestically and internationally.