Analysts’ warnings intensify as market conditions suggest significant challenges ahead for the US economy.

Economic strategies are at the forefront of discussions as BCA Research’s strategist, Peter Berezin, predicts a 75% likelihood of a recession occurring in the next three months. According to Berezin, traditional methods underestimate the effects of the ongoing trade war and reductions in DOGE, signaling a steeper economic downturn than anticipated.

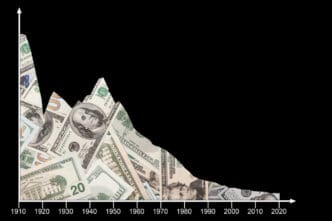

Berezin’s reputation for bearish predictions has grown. He forecasts the S&P 500 to end the year at 4,450, a stark contrast to its current standing of 5,738, having already dipped from a starting point of 5,903. With over three decades of economic experience, including positions at the International Monetary Fund and Goldman Sachs, Berezin’s insights carry weight.

Key factors underpinning Berezin’s outlook include the detrimental impact of higher tariffs on workers’ incomes, leading to reduced demand, and the resultant economic uncertainty affecting businesses. Inflation pressures heightened by tariffs could also limit the Federal Reserve’s capacity to cut interest rates.

JPMorgan economist Nora Szentivanyi adds to the conversation with her analysis, stressing that persistent tariff hikes could not only plunge the Mexican and Canadian economies into recession but also significantly hinder US growth.

Recent data, like the drop in The Conference Board’s Consumer Confidence Index, reflects growing angst over economic expansion constraints. Factors such as increased trade and tariff discussions, coupled with critiques of current governmental policies, fuel these concerns.

The Dallas Fed reports declining state manufacturing conditions, with significant drops in production and new orders indices.

Meanwhile, widespread layoffs, notably from job cuts in federal employment and the retail sector, underscore the grim outlook. Large retailers, including Walmart and Target, adjust their forecasts, accounting for anticipated tariff-related disruptions.

Financial markets exhibit signs of adjusting to these potential economic setbacks. Both the S&P 500 and Nasdaq Composite Index have retracted to pre-election levels, with notable declines from tech giants like Nvidia and Tesla, evidencing broader market apprehensions.

As experts weigh in on the economic forecast, careful attention is required. The analyses presented by Berezin and others warn of imminent challenges that could emerge in the coming months, urging readiness among market participants.