Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

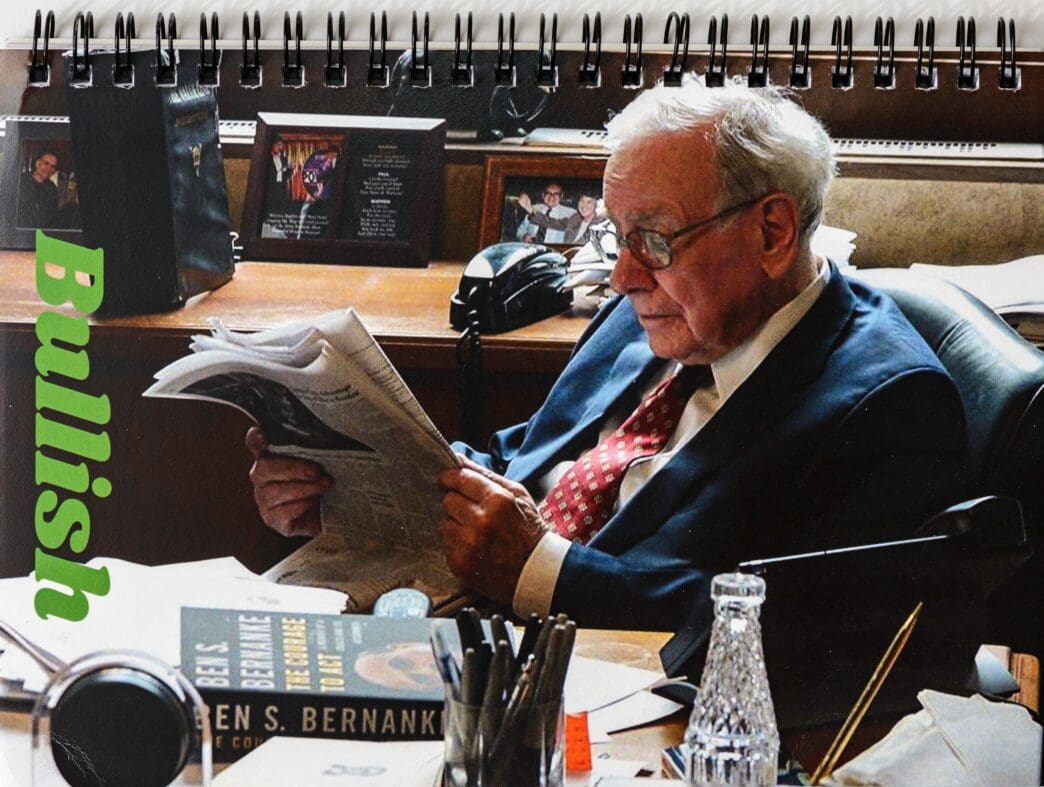

Warren Buffett’s Berkshire Hathaway significantly increased its stake in Chevron during the last quarter, purchasing nearly 3.5 million shares valued at approximately $520 million. This acquisition boosts Berkshire’s ownership to a 7% stake in the energy company, marking a notable reversal after several consecutive quarters of net selling by Buffett’s holding company.

Buffett’s History with Chevron

Berkshire Hathaway first initiated a position in Chevron in 2020, following a market downturn. The investment firm has since actively managed its stake, including a substantial reduction in early 2021 before rebuilding its position later that year. Subsequent periods in 2022 saw further purchases, including a significant acquisition of 121 million shares in the first quarter.

Despite being a net seller in six of the past seven quarters, the recent $520 million purchase represents one of Berkshire’s largest stock acquisitions for the quarter, underscoring renewed interest in the oil major.

Investment Rationale and Market Context

According to analysis within the source article, Chevron presents an attractive profile for investors. The company’s stock trades at approximately 19 times earnings, which is a discount compared to the S&P 500’s average of 31 times earnings. Additionally, Chevron offers a dividend yield of around 4.5%, supported by consistent free cash flow.

However, Chevron has faced challenges, with its stock trading sideways since 2022 due to declining oil prices, which fell below $60 per barrel. Rising global production is also expected to contribute to meaningful oil surpluses in 2026, creating a difficult operating environment for oil producers.

Strategic Positioning

As an integrated producer involved in refining, chemical production, and even energy generation, Chevron is positioned to manage industry cyclicality. The company’s CEO emphasizes cost controls and capital efficiency to maintain profit stability, even amidst lower oil prices. Despite current market headwinds, the article suggests that Chevron stock remains a compelling purchase for specific investor profiles.

Investors concerned about finding market value, anticipating a potential bear market, or expecting a recovery in oil prices due to geopolitical tensions may find Chevron shares to be a suitable investment. While not considered a deep bargain, the stock is argued to be fairly valued, with its dividend yield and free cash flow consistency potentially offsetting losses during market downturns.

Key Takeaways

The recent increase in Berkshire Hathaway’s Chevron holdings appears to reflect a classic value investing approach by Warren Buffett. In an environment where market bargains are perceived as scarce, Chevron’s business model, valuation, and dividend yield position it as a resilient option for investors seeking stability and potential upside amid ongoing market uncertainties.