Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

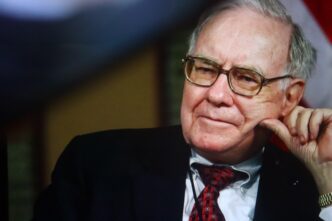

A valuation metric favored by Warren Buffett, which suggests the stock market is entering dangerous territory when it approaches 200%, currently stands at 223%, raising concerns among some investors. The “Buffett indicator,” which measures total stock market capitalization against gross national product (GNP) or gross domestic product (GDP), has historically served as a warning signal for market overvaluation. However, some market observers are questioning whether the rise of artificial intelligence (AI) might be changing fundamental market dynamics, potentially rendering traditional valuation metrics less relevant.

Buffett’s Valuation Warning

Warren Buffett outlined his valuation perspective in a 2001 article for Fortune magazine. He described the ratio of total stock market capitalization to GNP as “probably the best single measure of where valuations stand at any given moment.” Buffett noted that this metric soared to an all-time high in 1999 and early 2000, which he suggested “should have been a very strong warning signal” before the subsequent market crash.

In that article, Buffett stated that if the ratio ever nears 200%, investors are “playing with fire.” The indicator, now widely known as the Buffett indicator, currently sits at 223%, significantly above the threshold he cautioned against. Buffett’s conglomerate, Berkshire Hathaway, has also amassed its largest cash stockpile to date and has been a net seller of stocks for 12 consecutive quarters, reflecting a cautious stance.

The AI Factor

Despite Buffett’s historical warning, many investors appear to be largely disregarding it, with the S&P 500 near all-time highs. A growing argument suggests that the current market environment, largely influenced by advancements in artificial intelligence, may be fundamentally different from past cycles.

One key difference highlighted is the evolution of the indicator itself, with GDP largely replacing GNP as the preferred economic measure. More significantly, proponents of the “this time it’s different” argument point to AI’s potential to dramatically increase corporate efficiency and profitability. Technologies such as agentic AI, artificial general intelligence (AGI), and AI superintelligence (ASI) are seen as potential catalysts for radical transformations across business and society.

Buffett himself acknowledged in his 2001 article that the ratio “has certain limitations,” particularly as a snapshot that does not account for future market capitalization or economic growth. If AI unlocks substantial new value for businesses and the broader economy, the current high level of the Buffett indicator could be misleading.

Weighing the Risks

While the potential for AI to revolutionize the business world is considerable, dismissing Buffett’s long-standing warning carries inherent risks. Predictions from figures like Anthropic CEO Dario Amodei, who anticipates AI could increase unemployment by up to 20% within five years, and Tesla CEO Elon Musk, who foresees AI and robots replacing all jobs, suggest a future where corporate profits could skyrocket, potentially altering the relevance of traditional valuation metrics.

However, betting against the “Oracle of Omaha” has historically proven hazardous for investors. The current market presents a tension between a historically high valuation signal and the unprecedented transformative potential of artificial intelligence.