Executive Summary

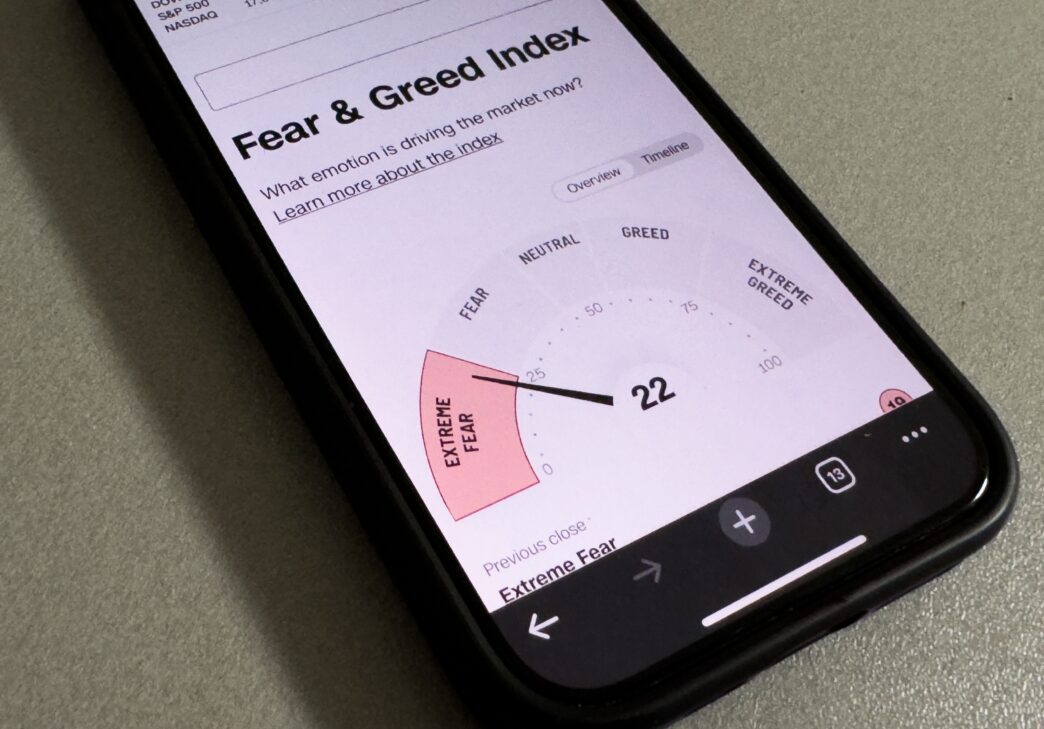

- Despite major U.S. stock indexes trading near all-time highs, the Fear & Greed Index registers “extreme fear” at a reading of 21, indicating widespread investor apprehension.

- This market sentiment divergence is driven by concerns over high market valuation (S&P 500 Shiller CAPE Ratio around 40) and the potential for an AI stock bubble.

- Seasonal market dynamics, including tax loss harvesting, also contribute to cautious sentiment, with some analysts suggesting a contrarian “buy the dip” approach in the event of a market sell-off.

The Story So Far

- Despite major U.S. stock indexes trading near all-time highs, widespread investor apprehension stems from concerns about market overvaluation, indicated by a high S&P 500 Shiller CAPE Ratio comparable to pre-dot-com bubble levels. Additionally, fears surrounding the sustainability of the artificial intelligence rally, viewed by some as a potential emerging bubble, coupled with typical year-end seasonal market dynamics like tax loss harvesting, are contributing to the “extreme fear” sentiment.

Why This Matters

- The current “extreme fear” among investors, despite major U.S. stock indexes trading near all-time highs, signals a significant market disconnect. This apprehension, driven by concerns over potential overvaluation (like the high Shiller CAPE Ratio) and the sustainability of the AI rally, implies a heightened risk of a market correction. Consequently, while the market appears strong, underlying sentiment suggests a fragile environment where a future sell-off could create strategic buying opportunities for contrarian investors.

Who Thinks What?

- Major U.S. stock indexes like the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average indicate a strong market, trading near all-time highs.

- The Fear & Greed Index registers “extreme fear” among investors, with some market observers expressing concern about potential market overvaluation and the sustainability of the AI rally.

- Some analysts suggest that the current “extreme fear” sentiment, despite high market levels, might present opportunities for a contrarian approach to “buy the dip” should a market sell-off occur.

Despite major U.S. stock indexes like the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average trading near all-time highs as of November 10, 2025, an important market indicator suggests widespread investor apprehension. The Fear & Greed Index, a barometer of market sentiment, currently registers a reading of 21, signaling “extreme fear” among investors.

Understanding the Divergence

The Fear & Greed Index, developed by CNN Business, quantifies investor sentiment on a scale from 0 to 100. Readings between 0 and 40 typically indicate fear, while scores from 60 to 100 suggest greed. The current reading of 21 highlights a significant disconnect between the strong performance of leading market indexes and the underlying sentiment.

Several factors appear to contribute to this pervasive fear. The S&P 500 Shiller CAPE Ratio, a valuation metric, is reportedly around 40. This level is comparable to those observed in the late 1990s, just before the dot-com bubble burst, raising concerns about potential market overvaluation.

Underlying Market Concerns

Investor apprehension is also fueled by questions surrounding the sustainability of the artificial intelligence (AI) rally. Some market observers are increasingly concerned that the rapid growth in AI-related stocks could represent an emerging bubble, potentially leading to a broader market correction.

Additionally, seasonal market dynamics may contribute to the cautious sentiment. The final months of the year often bring increased volatility, partly due to strategies like tax loss harvesting, where investors sell underperforming assets to offset capital gains, which can lead to temporary declines across the market.

Navigating Market Sentiment

While consistently predicting market movements remains challenging, historical trends suggest that the broader stock market tends to appreciate over the long term. Given the current “extreme fear” sentiment amidst high market levels, some analysts suggest that a contrarian approach might involve considering opportunities to “buy the dip” should a market sell-off occur.