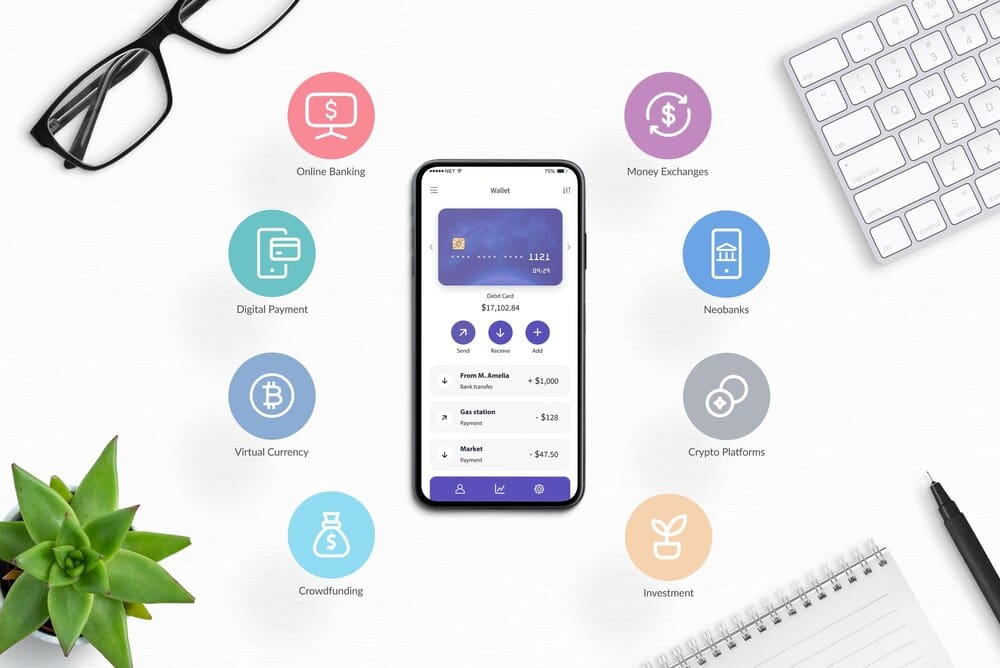

In an era where consumers can curate every aspect of their digital lives, from entertainment subscriptions to news feeds, the world of personal finance is undergoing a similar revolution. Forward-thinking individuals are now building their own “personal FinTech stack,” a bespoke collection of digital applications and services designed to manage, save, and grow their money with unprecedented efficiency. This strategic move allows users to cherry-pick the best-in-class tools for specific financial jobs—like budgeting, investing, and saving—and integrate them into a cohesive system that outperforms the one-size-fits-all model of a single traditional bank. For the modern consumer, this isn’t just about using apps; it’s about architecting a personalized financial ecosystem to gain superior control, minimize fees, and accelerate progress toward their most important financial goals.

What is a Personal FinTech Stack?

Think of a traditional bank as a pre-packaged toolkit from a hardware store. It has a hammer, a screwdriver, and a wrench, but they might not be the best quality or the perfect fit for every job. A personal FinTech stack, in contrast, is like visiting a specialty store and hand-selecting the absolute best hammer, the ideal screwdriver, and the most effective wrench for your specific needs.

At its core, a FinTech stack is a personalized suite of financial technology products that you choose and connect to manage your financial life. This concept is born from the “unbundling” of financial services. Where a single bank once offered checking, savings, loans, and investments under one roof, technology has enabled specialized companies to excel at just one of those things, often delivering a superior product with lower costs and a better user experience.

The goal is not necessarily to replace your traditional bank entirely, though some do. Instead, it’s about augmenting or replacing individual functions with more powerful, specialized tools. The result is a financial management system that is more efficient, insightful, and perfectly aligned with your personal objectives.

Step 1: Assess Your Financial Foundation

Before you can build, you must survey the land. The first step in creating your FinTech stack is a thorough and honest assessment of your current financial situation and goals. This foundational work will serve as the blueprint for the entire structure.

Start by asking yourself the big questions. What are you trying to achieve financially? Your goals could be short-term, like saving for a vacation, or long-term, like building a retirement nest egg or paying off a mortgage early. Be specific and write them down.

Next, map out your existing financial landscape. Create a simple list of every financial account you have: checking and savings accounts, credit cards, student loans, car loans, mortgages, and any investment or retirement accounts. Note the institution, the account balance, the interest rate (for both savings and debt), and any monthly fees you pay.

Finally, identify your pain points. What aspects of your financial life are frustrating, confusing, or costly? Are you earning next to nothing in interest on your savings? Are you paying high monthly maintenance fees on your checking account? Do you feel blind about where your money goes each month? These pain points are the problems your new FinTech stack will be designed to solve.

Step 2: Define Your Core Financial Pillars

With a clear understanding of your goals and pain points, you can now define the core pillars of your financial life. These pillars represent the fundamental jobs your money needs to do. Most people will need a tool for each of the following five categories.

Pillar 1: Banking & Cash Management

This is the central hub of your stack—the digital equivalent of a main checking account. It’s where your income is deposited and from which you pay your primary bills. The goal here is to find an account that is low-cost, efficient, and secure.

Look beyond traditional brick-and-mortar banks, which often come with high fees and low interest rates. Consider modern alternatives like neobanks (e.g., Chime, Varo) or high-yield cash management accounts offered by brokerage firms. The key features to prioritize are zero monthly fees, ATM fee reimbursements, a high-quality mobile app, and, critically, FDIC insurance to protect your deposits.

Pillar 2: Budgeting & Spending Insights

This pillar acts as the brain of your financial system, providing clarity on your cash flow. A good budgeting app aggregates all your financial accounts in one place, automatically categorizes your transactions, and shows you exactly where your money is going.

There are two main philosophies here. Apps like Mint or Copilot Money are excellent for passively tracking spending and getting a high-level overview. For those who want more hands-on control, the “zero-based budgeting” method used by apps like YNAB (You Need A Budget) requires you to proactively assign every dollar a job, promoting greater intentionality with your spending.

Pillar 3: Saving & Goal Setting

This is the engine that powers your future goals. The primary tool for this pillar is almost always a High-Yield Savings Account (HYSA). Offered by online-only banks (e.g., Ally Bank, Marcus by Goldman Sachs), HYSAs provide interest rates that are often 10 to 20 times higher than those at traditional banks, allowing your savings to grow significantly faster.

You can supplement an HYSA with automated savings apps. Services like Digit analyze your spending and automatically pull small, safe amounts of money into savings. Others, like Acorns, use a “round-up” feature, investing the spare change from your daily purchases. The key is to automate the act of saving so it happens consistently without requiring willpower.

Pillar 4: Investing & Wealth Building

For your long-term goals like retirement, savings alone won’t be enough; you need to invest. The FinTech landscape offers a wide array of options tailored to different experience levels and risk appetites.

For beginners or those who prefer a hands-off approach, robo-advisors like Betterment and Wealthfront are excellent choices. They build and manage a diversified portfolio for you based on your goals and risk tolerance, all for a low annual fee. For more hands-on investors, modern discount brokerages like Fidelity, Charles Schwab, and Vanguard offer commission-free trading of stocks and ETFs with powerful research tools.

Pillar 5: Credit & Debt Management

This pillar is about maintaining your financial health and responsibly managing debt. Start by using a free credit monitoring service like Credit Karma to keep an eye on your credit score and report. Understanding the factors that influence your score is the first step to improving it.

If you have debt, certain apps can help you create a strategic payoff plan using methods like the “debt avalanche” (paying off highest-interest debt first) or “debt snowball” (paying off smallest balances first). While Buy Now, Pay Later (BNPL) services can be a part of this pillar, they should be used with extreme caution and a clear repayment plan to avoid accumulating high-interest debt.

Step 3: Select Your Tools and Apps

With your pillars defined, it’s time to choose your tools. The key is to start small and prioritize. Address your biggest pain point first. If high bank fees are your main issue, your first move should be opening a new fee-free checking account.

Do your research. Read reviews from trusted financial publications, compare fee structures, and look for user testimonials. Pay close attention to security features. Any financial app you use should offer multi-factor authentication (MFA) and state-of-the-art encryption to protect your data and money.

Remember the “best-of-breed” philosophy. Resist the temptation to find one app that does everything mediocrely. The power of the stack comes from selecting the absolute best app for each specific job.

Step 4: Connect and Automate

A collection of apps only becomes a “stack” when its components work together. This integration is made possible by data aggregation services like Plaid and Finicity, the secure technology that allows you to link your bank account to a budgeting app or an investment platform.

Once your tools are chosen, the most crucial step is to set up automations. This is what puts your financial plan on autopilot and ensures progress. Create rules like an automatic transfer from your core banking account to your HYSA and your investment account the day after you get paid. This “pay yourself first” strategy is one of the most effective wealth-building habits.

By automating your savings and investments, you remove emotion and forgetfulness from the equation. Your financial system works for you in the background, consistently executing your plan.

Step 5: Review and Refine Regularly

Your FinTech stack is a living system, not a static monument. Your financial life will change—you might get a raise, buy a home, or have children. Your stack should evolve with you.

Schedule a financial check-in at least twice a year. During this review, assess each component of your stack. Is your budgeting app still meeting your needs? Has a new HYSA emerged with a much better interest rate? Is your investment strategy still aligned with your long-term goals? Don’t be afraid to swap out a tool if a better one comes along. The low switching costs are a primary advantage of this modular approach.

Building Your Financial Future

Constructing a personal FinTech stack is a declaration of financial empowerment. It marks a shift from being a passive recipient of services to becoming the active architect of your own financial well-being. By thoughtfully selecting and integrating the best digital tools available, you can build a system that is more transparent, less expensive, and infinitely more effective at helping you achieve your goals. In the digital age, financial control is no longer a luxury reserved for the wealthy; it is a tangible reality available to anyone with a smartphone and the will to build a smarter financial future.