KEY POINTS

- The FinTech stack is a layered architecture of modern technologies that enables seamless, instant, and intuitive financial services, which is a significant departure from rigid, monolithic legacy systems.

- The stack’s core philosophy is unbundling the bank, which breaks down traditional financial functions into modular services that can be connected seamlessly. This allows for greater agility, scalability, and specialization.

- The stack is composed of several critical layers, including foundational cloud infrastructure, Banking-as-a-Service (BaaS) platforms for regulated services, an intelligence and security layer powered by AI and data analytics, and a user-friendly application layer.

In the last decade, financial services have undergone a seismic shift. Sending money to a friend, getting approved for a loan, or investing in stocks can now be done in seconds from the palm of your hand. This seamless, instant, and intuitive experience is powered by a complex, layered architecture of modern technology known as the FinTech Stack.

Think of a FinTech application not as a single piece of software, but as a sophisticated engine built from a set of specialized, interconnected components. The FinTech stack is the complete collection of these technological “building blocks”—from foundational cloud servers to the user-facing application—that work in harmony to deliver a financial product or service. Understanding this stack is essential to grasping how modern finance is built and why it has become so agile and innovative. This guide will deconstruct the FinTech stack, exploring each of its critical layers and revealing how they combine to power the digital finance revolution.

The Philosophy: Why a “Stack”?

To appreciate the modern FinTech stack, one must first understand what it replaced. Traditional banks were built on monolithic, closed-off mainframe systems. These legacy systems were all-in-one behemoths—secure and reliable, but also incredibly rigid, expensive to maintain, and slow to change. A simple update could take months or even years to implement.

The FinTech revolution was born from a new philosophy: unbundling the bank. Instead of one massive, inflexible system, FinTech pioneers envisioned a modular approach. They broke down the functions of a bank—payments, lending, investing, savings—into individual services. The “stack” is the architectural manifestation of this idea. It allows companies to pick and choose the best tools for each specific job and connect them seamlessly, much like snapping together digital Lego bricks.

This modular approach provides three core advantages:

- Agility: Developers can rapidly build, test, and deploy new features without overhauling the entire system.

- Scalability: Companies can easily scale their operations up or down by leveraging cloud-based services, paying only for the resources they use.

- Specialization: It allows companies to focus on their core competency (like a great user experience) while relying on specialized partners for other functions (like regulatory compliance or payment processing).

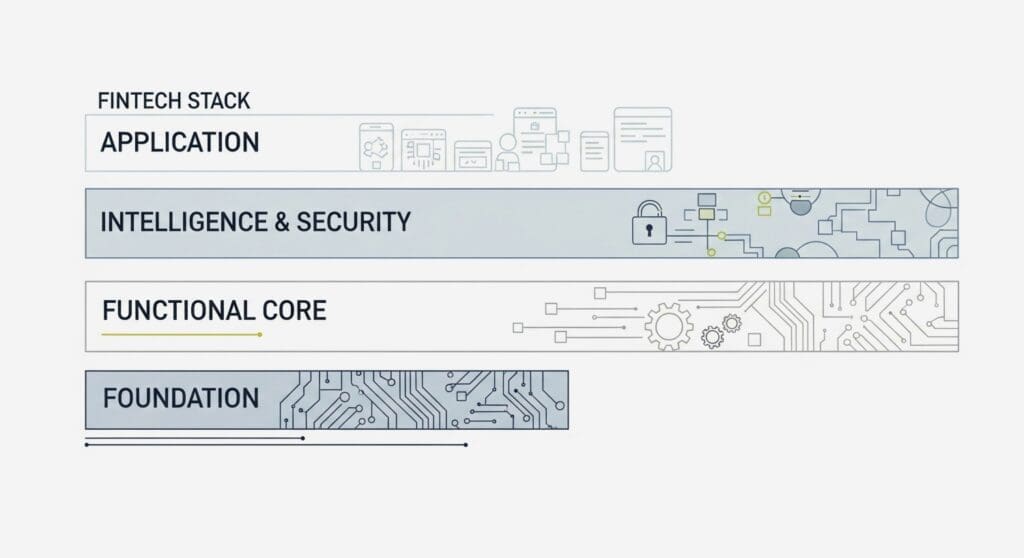

Deconstructing the FinTech Stack: The Core Layers

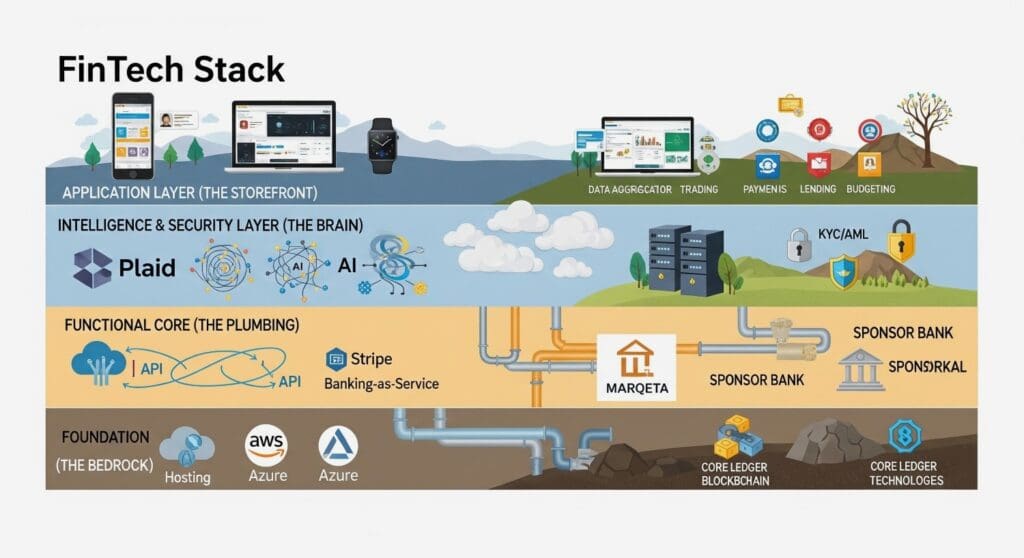

A FinTech stack can be visualized as a series of layers, starting with the most fundamental infrastructure at the bottom and ending with the user-facing application at the top. Each layer builds upon the one below it.

Layer 1: The Foundation – Core Infrastructure (The Bedrock)

This is the non-negotiable base layer upon which everything else is built. It provides the raw computing power and the fundamental system of record.

- Cloud Hosting: Virtually all modern FinTechs are built on the cloud. Services like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure provide the servers, storage, networking, and databases. This eliminates the need for expensive physical data centers and allows for immense scalability and reliability.

- Core Banking System / Ledger Technology: Every financial application needs a “source of truth”—a secure ledger that authoritatively tracks who owns what. In some cases, this might be a modern Core Banking System (CBS) licensed from a provider. Increasingly, this layer is being reinvented with proprietary ledgers or, in the world of crypto and DeFi, a blockchain, which serves as a decentralized and immutable ledger.

Layer 2: The Functional Core – “Banking-as-a-Service” (The Plumbing)

Most FinTech startups are not licensed banks. To offer regulated financial products like FDIC-insured accounts or issue debit cards, they need to connect to the traditional banking system. This layer provides the essential, regulated financial plumbing.

- Sponsor Banks: These are chartered, regulated banks (like Evolve Bank & Trust or Bancorp Bank) that partner with FinTechs. They hold the necessary licenses and provide the regulatory framework, allowing the FinTech to legally offer banking products.

- Banking-as-a-Service (BaaS) Platforms: These are the critical intermediaries that make the stack work. Companies like Stripe, Galileo, Marqeta, and Unit package the complex services of sponsor banks into a simple set of Application Programming Interfaces (APIs). Through a BaaS provider, a FinTech can instantly access functionalities like opening accounts, processing payments, issuing cards, and managing compliance, without having to build direct, complex integrations with a bank.

Layer 3: The Intelligence & Security Layer (The Brain)

This layer is where data is aggregated, analyzed, and secured. It’s what makes a FinTech app “smart” and safe, enabling it to make intelligent decisions and protect its users.

- Data Aggregation & Analytics: To provide a holistic financial picture, apps need to connect to users’ various bank accounts. Plaid is the undisputed leader in this space, providing an API that allows users to securely link their bank accounts to an app. This data is then used for everything from budget tracking to income verification for a loan.

- Artificial Intelligence (AI) & Machine Learning (ML): AI is the engine of modern FinTech intelligence. It powers credit risk models for lending, detects fraudulent transactions in real-time, provides personalized product recommendations, and runs customer service chatbots.

- Cybersecurity & Identity Verification (KYC/AML): Trust is paramount in finance. This part of the stack is dedicated to security. It includes tools for encrypting data, protecting against cyberattacks, and verifying user identities to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Layer 4: The Application Layer – User Experience (The Storefront)

This is the only layer the end-user ever sees. It’s the mobile or web application itself—the sleek interface, the intuitive buttons, and the seamless workflows.

- Front-End Application (Web/Mobile): This is the visual and interactive part of the app, designed to be as user-friendly as possible. The goal is to abstract away all the complexity of the underlying layers into a simple, elegant experience.

- APIs for Integration: The front-end application communicates with all the lower levels of the stack via APIs. When you click “send money,” the app’s API sends a secure request to the BaaS provider (Layer 2), which in turn communicates with the core ledger (Layer 1) to execute the transaction.

The Future of the FinTech Stack

The FinTech stack is not static; it is constantly evolving. Two major trends are shaping its future:

- Embedded Finance: The stack is becoming so modular and easy to integrate that financial services are being embedded into non-financial applications. When you use “Buy Now, Pay Later” on a retail website or get insurance through your car manufacturer’s app, you are interacting with an embedded FinTech stack.

- Decentralized Finance (DeFi): Blockchain technology is moving beyond being just a ledger in Layer 1. In DeFi, the entire stack—from the core logic to the application layer—is built on a decentralized, transparent, and programmable blockchain like Ethereum, replacing trusted intermediaries with smart contracts.

Conclusion

The FinTech stack is the invisible architecture behind the financial convenience we now take for granted. It represents a fundamental shift from rigid, monolithic systems to a flexible, API-driven, and layered ecosystem. By combining the rock-solid infrastructure of the cloud, the regulated plumbing of partner banks, the intelligence of AI, and a relentless focus on user experience, this stack enables innovators to build the future of finance faster, cheaper, and more creatively than ever before. It is the engine that will continue to drive financial innovation for years to come.