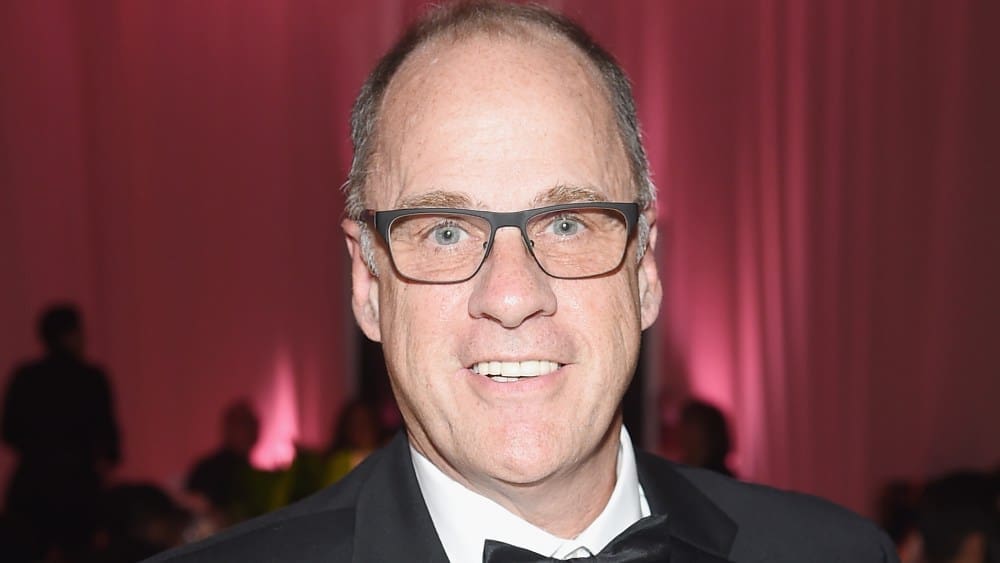

Ted Farnsworth, the former mastermind behind MoviePass, finds himself in a legal bind. Investors were left in a lurch as Farnsworth admitted to deceiving them. It’s a tale of ambition gone awry. A cautionary story for entrepreneurs.

Farnsworth, aged 62, couldn’t escape the long arm of the law. Tuesday marked his guilty plea to securities fraud. The admission sheds light on the dark side of the business world. Yet, it raises questions about corporate accountability.

The Rise and Fall of MoviePass

MoviePass, once hailed as a revolution in cinema subscriptions, collapsed spectacularly. The $9.95-a-month plan seemed too good to be true—and it was. The service soared to 3 million subscribers but fell under the weight of financial impracticalities.

Behind the curtain, Farnsworth and his cohort, Mitchell Lowe, claimed profitability hinged on customer data. Investors, lured by these promises, later discovered a bleak financial reality. The company spiraled into bankruptcy by 2020, marking a dramatic end to its rapid rise and fall.

Legal Troubles Unraveled

In November 2022, the law caught up with Farnsworth, leading to charges of investor deception. Prosecutors unveiled a web of lies entailing nonexistent revenue streams and dubious sustainability claims.

Adding fuel to the fire was Farnsworth’s secret venture—a video platform that never saw the light of day. The government argued this parallel scheme exemplified his deceptive strategies, furthering his financial deceit.

Farnsworth’s legal woes compounded when the SEC barred him from any corporate leadership in publicly traded companies. The proceedings exposed flaws in corporate governance and raised serious ethical concerns.

The Conspiracy Charges

Amidst the MoviePass debacle, Farnsworth faced additional scrutiny. He was implicated in conspiracy charges linked to Vinco Ventures, a company he clandestinely controlled.

Vinco Ventures allegedly secured $120 million from investors on shaky grounds. The company pledged bold ideas for a media platform, but little materialized. Investors faced mounting losses as stock values plummeted.

Farnsworth’s actions left a trail of financial ruin, shattering the trust of stakeholders who lost significant investments.

A Fall from Grace

As 2021 came to an end, Farnsworth found himself embroiled in a deeper scandal. Revelations emerged of extravagant expenditures, including escort services paid with corporate funds.

The court heard how his mismanagement led to his million-dollar bond being revoked, culminating in his federal custody. The flamboyant lifestyle clashed starkly with the claims of business acumen he once sold.

This stark reality paints a vivid portrait of excess and irresponsibility at the helm of corporate leadership.

A New Beginning for MoviePass?

After bankruptcy, MoviePass isn’t entirely gone. It relaunched under new ownership, promising to shed its troubled past.

The revamped business model aims to reclaim consumer trust lost during Farnsworth’s tenure. Whether the public is forgiving remains a point of interest.

With its second chance, MoviePass must navigate past missteps while seeking a sustainable future.

Ripple Effects on the Industry

MoviePass’ saga underlines the importance of transparency and accountability in the business arena. Companies across industries are reminded of the repercussions of misleading investors.

As the industry takes heed, Farnsworth’s downfall serves as a stark warning against ignoring prudent business principles.

Investors and consumers alike now scrutinize corporate practices with heightened vigilance, fostering an environment demanding higher ethical standards.

An Industry Reflection

The Farnsworth case invites introspection within the industry.

It opens a dialogue about the balance between innovation and ethical responsibility, challenging the entrepreneurial playground to uphold integrity.

Farnsworth’s tale is a potent reminder of the ethical lines entrepreneurs must toe.

Legal Recourse and Business Ethics

Regulatory bodies now stress ethical governance, propelled by Farnsworth’s fraudulent escapades. The legal community presses for stiffer regulations to deter such misconduct.

The implications of this case stretch far beyond MoviePass, prompting systemic reforms throughout corporate echelons.

As reforms take shape, businesses must align their strategies with legal and ethical norms, ensuring responsible leadership.

Farnsworth’s saga calls for robust oversight to prevent future frauds, as stakeholders demand a more transparent and accountable corporate framework.

Farnsworth’s Next Moves

With a guilty plea entered, Farnsworth looks at potential sentencing that could shape his future. He faces an uncertain pathway, both legally and personally.

The court proceedings are expected to outline his repercussions, setting a precedent for similar offenses.

This high-profile case underscores the need for vigilance against white-collar crime.

The Public’s Verdict

Farnsworth’s fall from grace ignites discussion among the public. Questions of morality and integrity take center stage.

As society evaluates his actions, the broader implications on corporate behavior are dissected.

The community’s thirst for justice speaks volumes, reflecting an appetite for rooting out corporate misconduct.

Farnsworth’s tale serves as a powerful reminder of the hazards of unchecked ambition. It’s a lesson etched in the annals of corporate mishaps.

Source: Variety