With President Joe Biden’s student loan initiatives currently stalled in legal proceedings, the incoming Trump administration poses new uncertainties for millions of borrowers.

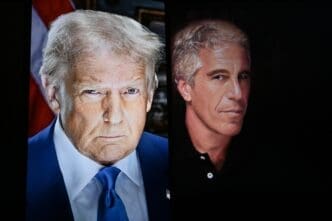

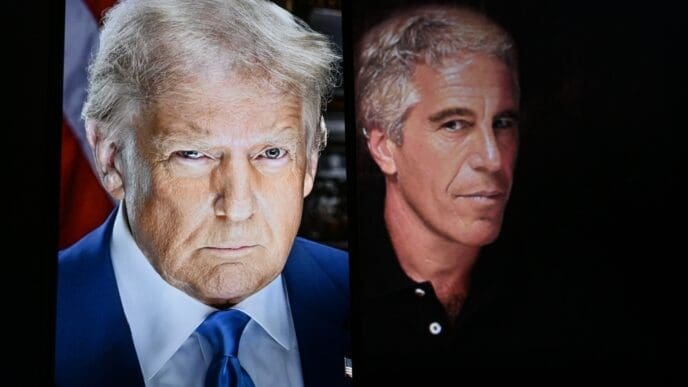

President-elect Donald Trump has not committed to specific student loan policies, contrasting with Biden’s administration, which prioritized student loan forgiveness. Trump’s lack of promises on student financial aid raises concerns among borrowers who benefited from Biden’s programs.

During previous Republican challenges, the Supreme Court struck down Biden’s comprehensive student loan forgiveness plan. Trump criticized the proposal, labeling it unfair to individuals who have fulfilled their debt obligations through hard work.

Trump’s first term saw efforts to dismantle public-sector loan forgiveness programs and restrict relief for those misled by their educational institutions. Though these attempts were unsuccessful, they left many borrowers in limbo regarding their debt relief claims.

Potential changes under the Trump administration could include altering Biden’s SAVE repayment plan. As it’s embroiled in litigation, a decision by the 8th US Circuit Court of Appeals could determine the plan’s fate. The Trump administration may choose to abandon the plan or halt court defenses.

The SAVE plan, initiated last year, offered favorable terms for low-income borrowers. Some would pay as little as 5% of discretionary income, with debt cancellation possible after ten years of payments. Presently, enrolled borrowers have their repayments paused due to litigation-related forbearance.

Despite Biden’s expansion of student loan forgiveness programs, achieving $175 billion in debt relief, Trump’s potential pursuit of policy reversals remains uncertain. Implementation challenges and legal battles could impede Trump administration efforts to rescind established debt relief.

The Trump administration previously attempted to phase out the Public Service Loan Forgiveness program, which waives remaining student loans after a decade for qualifying public workers. However, repealing the program requires legislative approval, a hurdle not previously cleared.

Trump also tried to restrict the borrower defense rule, limiting relief to those misled by their colleges. His administration faced criticism over these efforts, culminating in court battles and a significant backlog of claims left unresolved.

In his campaign rhetoric, Trump has suggested closing the Department of Education. Such a move would necessitate congressional action, a potentially significant barrier. Discussions have floated the idea of transferring student loan responsibilities to the Department of Treasury.

The evolving landscape of student loans under Trump’s administration leaves borrowers facing potential shifts in policies. The administration’s approach will significantly influence millions of Americans managing student debt.

Source: CNN