WASHINGTON D.C. – The U.S. Federal Reserve, facing relentless public pressure from President Donald Trump, decisively opted on Wednesday to maintain its benchmark interest rates at 4.25%-4.5%. This decision, widely anticipated by economists but openly defied by the President, underscores the central bank’s steadfast commitment to its independence despite political admonishments.

The Federal Open Market Committee (FOMC), the Fed’s monetary policy-setting body, also unveiled updated economic projections that paint a more cautious picture for the nation’s future. These revised forecasts predict lower economic growth and higher inflation than previously estimated, leading officials to signal only a modest 0.5 percentage point reduction in rates through the end of the year, likely delivered in two 0.25% increments, though no specific timeline was given. This adjustment reflects the increasing complexities and uncertainties influencing the U.S. economy.

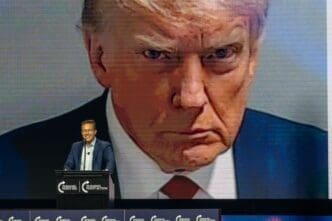

Trump’s Public Outburst and Challenges to Fed Independence

As the Fed meeting was underway, President Trump launched a scathing public attack on Chairman Jerome Powell from the White House lawn. “We have a stupid person, frankly, at the Fed,” Trump asserted, comparing the U.S. central bank’s inaction to Europe’s reported ten rate cuts. “He probably won’t cut today. …I guess he’s a political guy, I don’t know. He’s a political guy who’s not a smart person. But he’s costing the country a fortune.”

The President’s remarks escalated to threats regarding Powell’s tenure, stating, “So what I’m going to do, he gets out in about nine months, he gets, fortunately, terminated.” He even mused about directly taking control of monetary policy: “Maybe I should go to the Fed. Am I allowed to appoint myself? I’d do a much better job than these people. Anyway, we should be two points lower. It would be nice to be two and a half points lower.” These comments, drawing parallels to past populist leaders who sought to undermine central bank autonomy, highlight a significant ideological clash over the separation of powers in economic governance.

Chairman Powell is scheduled to address the press later Wednesday to provide further context on the FOMC’s decisions. Throughout his tenure, Powell has consistently avoided engaging in direct verbal sparring with President Trump, yet he has unequivocally maintained that the Fed will not succumb to political pressure, emphasizing its data-driven approach to policy.

Data-Dependent Decisions Amid Shifting Forecasts

The Fed’s official statement reiterated that future interest rate decisions will remain contingent on evolving economic data. While investors largely expect rates to hold steady at the upcoming July 30 meeting, there is a growing consensus that a rate cut becomes more probable in September.

In its quarterly Summary of Economic Projections, the Fed’s members recalibrated their forecasts for key economic indicators. Compared to their March projections—made before what Trump termed “Liberation Day,” referring to a shift in his administration’s tariff strategy—the new roadmap anticipates not only lower GDP growth but also a higher unemployment rate and elevated inflation. Previously, Fed members had favored two 0.25-point rate cuts by year-end, bringing rates to 3.75%-4.00%. The revised outlook indicates a more challenging path for the central bank, which operates under a dual mandate to ensure both price stability and maximum employment.

Tariffs, Geopolitics, and the Soft Landing Challenge

The updated economic roadmap explicitly reflects the significant challenges introduced by President Trump’s economic and trade policies. His “ever-changing tariffs” are identified as a primary source of uncertainty, complicating the Fed’s ability to achieve its dual mandate. The direct effects of these tariffs, coupled with the instability they create, are making spending and investment decisions increasingly difficult for both consumers and businesses.

Moreover, the escalating conflict between Israel and Iran, with its attendant risk of wider regional instability, casts a long shadow over the economic outlook. The recent surge in global oil prices due to this geopolitical tension is expected to translate into higher costs at the gas pumps and contribute to a rise in the consumer price index, further complicating the Fed’s efforts to manage inflation.

The central bank’s prevailing thesis has been that its monetary policy is positioned to “wait and see”—allowing time for economic measures to fully manifest their effects and for clearer data to emerge. So far, Chairman Powell has largely succeeded in guiding the U.S. economy toward a “soft landing,” managing to bring inflation closer to the 2% target without triggering widespread job losses or a severe recession. However, the confluence of tariffs and geopolitical shocks poses a substantial threat to this delicate balance.

Trump’s Refinancing Play and the Debate Over Trust

President Trump’s vocal criticisms of Chairman Powell, whom he has publicly labeled an “imbecile” and “too-late Powell,” underscore his desire for the Fed chairman to align monetary policy with his administration’s fiscal objectives. Trump frequently advocates for lower interest rates to reduce the cost of financing the national debt, which significantly increased during his first term and is projected to continue its rapid growth.

Yet, experts caution that simply cutting short-term rates does not guarantee a corresponding reduction in long-term Treasury rates. These longer-term rates have, in fact, risen due to investor distrust stemming from Trump’s policies, rather than the Fed’s monetary stance. If investors lose faith in the central bank’s commitment to fighting inflation, rate cuts could prove counterproductive, potentially leading to runaway prices.

Adding to the complexity, Trump has expressed concerns about an abundance of short-term debt maturities, indicating a desire to refinance these obligations over the coming months. He openly states his hope to do so before Powell’s term concludes, enabling him to appoint a new Fed chairman—with Treasury Secretary Scott Bessent reportedly among the potential candidates—who would be more amenable to his vision for lower interest rates and debt management. This strategic maneuvering highlights the high stakes in the ongoing battle for the future direction of U.S. economic policy.