The Adani Group, spearheaded by Indian tycoon Gautam Adani, witnessed a significant downturn as its shares plummeted up to 20% this Thursday. This sharp decline follows U.S. prosecutors indicting Adani on charges surrounding a vast solar energy project in India. These charges include allegations of securities fraud and conspiracy, drawing global attention and sparking fresh controversy around the billionaire magnate.

The indictment by federal prosecutors in New York, made public on Wednesday, accuses Adani of duping investors by allegedly facilitating the project through a bribery scheme. Consequently, the Adani Group has opted to halt a planned U.S. dollar bond offering, as disclosed in communications with the Bombay Stock Exchange and the National Stock Exchange of India.

An analysis of Adani’s background reveals his rise from Ahmedabad’s middle-class origins to becoming a dominant business figure in India. Adani’s ventures began with diamond trading in Mumbai and evolved over the decades through strategic investments in infrastructure and coal. His flagship company, Adani Enterprises, spans diverse sectors, making it India’s second-largest conglomerate.

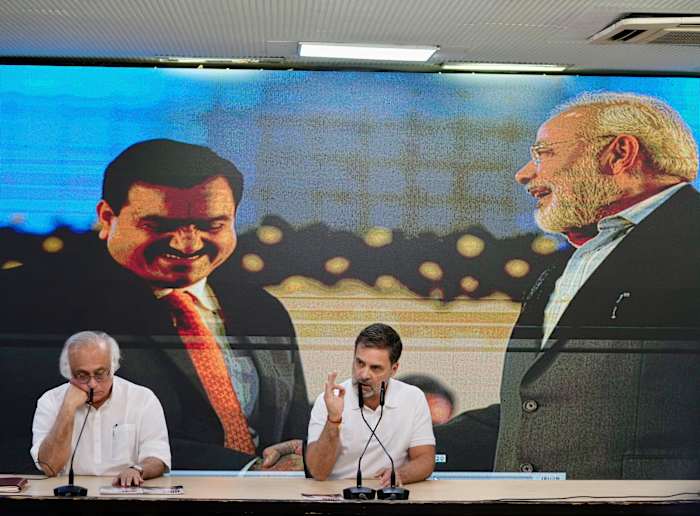

Critics often link Adani’s rapid ascent to his close association with India’s Hindu nationalist government. Opposition figures like Congress party leader Rahul Gandhi have questioned these ties, alleging that Adani’s political connections have facilitated his business success. Controversies have surfaced regarding preferential treatment in government contracts, although Adani denies these claims.

In the past, Adani companies faced market volatility, notably losing $68 billion in market value after allegations from U.S.-based Hindenburg Research accused the group of stock manipulation and fraud. Although Adani refuted these allegations, the accusations prompted broader concerns about the group’s transparency and governance.

The mounting legal challenges have renewed calls from India’s opposition for deeper investigations into Adani’s business practices. Congress party leader Jairam Ramesh emphasized the need for a parliamentary inquiry, citing potential monopolization in crucial sectors as a substantial economic challenge.

Adani’s proximity to influential political figures has historically supported his business expansion. Yet, past affiliations with political rivals illustrate his strategic adaptability. Supporters argue that his investments, particularly in renewable energy and international projects, align with national interests, offering India a competitive edge against major players like China.

The ongoing legal battles and market reactions underscore underlying tensions surrounding Adani’s vast empire. As the international community watches, the outcomes of these legal proceedings could significantly impact both Adani’s ventures and broader economic dynamics in India.

Source: News4jax