Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

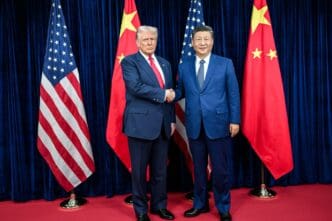

President Donald Trump and Chinese leader Xi Jinping recently met in South Korea, where they reached an agreement to reduce U.S. tariffs on Chinese goods by 10%. This concession was made in exchange for Beijing’s commitment to intensify its efforts against the flow of fentanyl into the United States, marking a notable development in the ongoing trade conflict initiated by Trump’s administration.

Trade Relations and Tariff Adjustments

The recent agreement aims to temper the years-long trade war, which saw President Trump impose tariffs on China, Canada, and Mexico in February 2025. Following the 10% reduction, the effective tariff rate on Chinese goods entering the U.S. will still stand at approximately 47%.

This period has been characterized by a “chaotic relationship” between the two economic powers, with retaliatory tariffs at times reaching triple-digit levels. The latest discussions between Trump and Xi sought to address these strained trade dynamics and other pressing issues.

China’s Shifting Trade Landscape

Data indicates a significant shift in China’s trade patterns since the escalation of tariffs. Even prior to Trump’s second term, China’s exports to the U.S. had been declining, a trend that has accelerated over recent months.

In September, Chinese exports to the U.S. totaled $34.3 billion, representing a 27% decrease from $47 billion in the same month last year. Despite this downturn in trade with the U.S., overall Chinese exports have increased by 6.1% this year, with September figures showing an 8.3% rise compared to a year earlier.

This growth is primarily driven by surging exports to other global markets, as China actively diversifies its export destinations. Concurrently, China is also importing more products from non-U.S. countries, seeking alternatives to American goods.

Impact on Key Agricultural Commodities

Soybeans

Soybeans, a critical commodity for both the U.S. and China, have been central to trade negotiations. Chinese imports of American soybeans have consistently declined, culminating in no imports from the U.S. in September for the first time in years.

Instead, China has significantly increased its soybean purchases from Brazil and Argentina. In September, the Argentinian government’s temporary suspension of its soybean export tax prompted China to buy approximately 1.2 million metric tons from the South American nation.

Following the meeting between Trump and Xi, Treasury Secretary Scott Bessent announced that China committed to buying 12 million metric tons of soybeans this season and 25 million metric tons annually for the next three years. This commitment follows a rise in Chicago soybean futures ahead of the leaders’ talks.

Beef

China, traditionally the third-largest buyer of American beef, has also drastically reduced its imports of the commodity. From January to July of this year, Chinese purchases of U.S. beef amounted to $481 million, accounting for 8% of total U.S. beef exports.

This represents a 47% decline compared to the same period last year, when Chinese purchases constituted 15% of overall American beef exports. The decline continued into last month, with China purchasing only $11 million worth of American beef, a 90% drop from $110 million in September of the previous year.

Similar to soybeans, China has compensated for reduced U.S. beef imports by increasing purchases from other countries, notably Australia and Argentina, after failing to renew beef contracts with the U.S. earlier this year.

Outlook

The recent tariff adjustments signal a potential de-escalation in the U.S.-China trade conflict. However, the accompanying data illustrates China’s strategic shift toward diversifying its trade partners and reducing its reliance on American commodities, reshaping global trade flows.