Executive Summary

The Story So Far

Why This Matters

Who Thinks What?

India’s foreign ministry announced Thursday that Indian companies have secured licenses to import rare earth magnets from China, signaling a potential, albeit limited, easing in Beijing’s stringent export controls on these critical materials. The decision comes amidst escalating global concerns over China’s near-monopoly on rare earth processing and its strategic use of these resources as geopolitical leverage.

The Announcement and its Context

Foreign ministry spokesperson Randhir Jaiswal confirmed the issuance of the licenses during a media briefing. However, he did not disclose specific details regarding the companies involved, the total number of licenses granted, or any conditions attached to their approval.

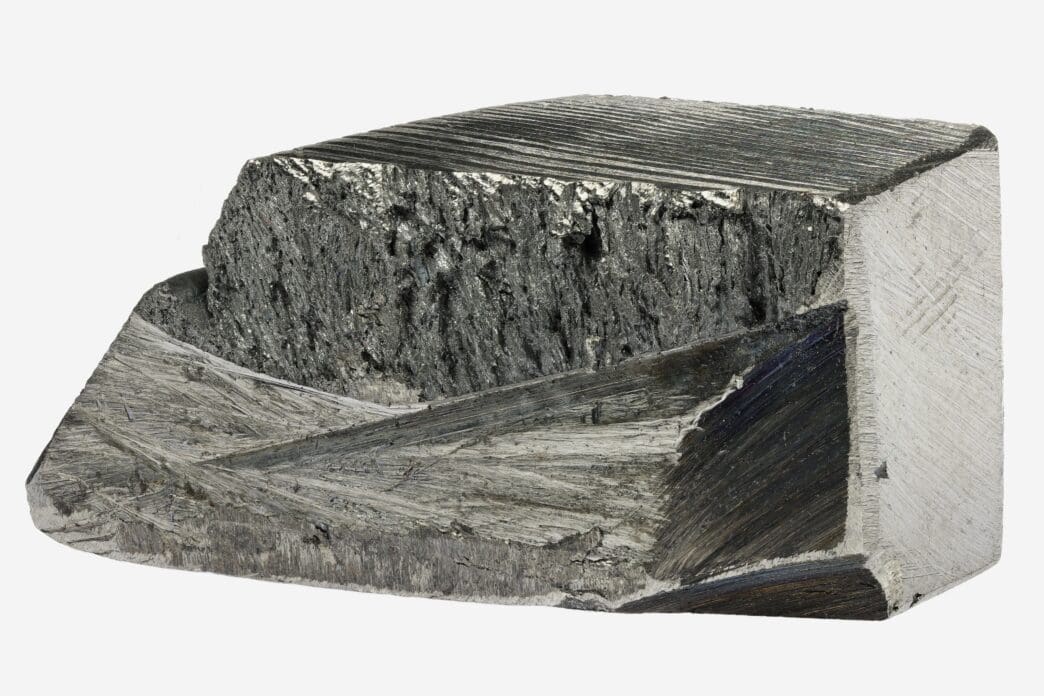

Rare earths, a group of 17 elements, are indispensable in the manufacturing of various high-tech products, including electric vehicles, advanced aircraft, and sophisticated weaponry. China maintains a dominant position in the technology required to process these raw minerals into finished magnets.

China’s Export Control Strategy

Beijing has increasingly tightened its exports of processed rare earth materials to major economies, including India, throughout the current year. This strategy is widely seen as an effort to reinforce China’s geopolitical influence amid ongoing trade tensions, particularly with the United States.

Earlier on the same day, China reportedly agreed to delay the introduction of its latest round of rare earth export controls. This agreement was part of a deal between President Donald Trump and Chinese leader Xi Jinping, though previous restrictions remain in effect.

In October, China significantly expanded its rare earths export controls to include five new elements and dozens of refining technologies. These new regulations also mandate that foreign producers utilizing Chinese materials must comply with China’s domestic export-control system.

The October 9 announcements also introduced new restrictions on electric battery equipment and industrial diamonds. These battery-related curbs prompted a rush among global customers, including India’s Reliance Industries, to accelerate shipments before an early-November deadline.

Global Supply Chain Risks

China’s earlier export controls on rare earths, implemented in April, led to significant shortages that threatened to disrupt global car production. These actions have underscored the inherent risks associated with an over-reliance on a single supplier for critical industrial components.

Outlook

While the new licenses offer some relief for Indian companies, the broader landscape of China’s strategic control over rare earths remains a significant factor in global supply chain stability. The situation continues to highlight the ongoing efforts by nations to manage dependencies on critical raw materials.